About four hours ago, Iowa’s Attorney General Tom Miller testified to the Senate Banking Committee it would be months before the combined AG “investigation” came up with a settlement (he also suggested that there were new aspects that were just being added to the “investigation”).

Dodd: How long AG investigation?

Miller: Months, rather than year or longer. Depends on negotiations. If we expand scope, expands time. Maybe something on fees allowed. Forced insurance, huge abuse. Same thing w/dual track. If you all could solve the 2nd lien problem.

That’s almost exactly the moment when the WaPo posted a story reporting the AGs were close to a settlement.

The 50 state attorneys general are in negotiations over an agreement over foreclosures that would include a victims’ compensation fund that would provide money for borrowers whose homes have been taken away improperly, according to state and industry officials.

The discussions are still preliminary and the final deal may change significantly as details are hammered out and the settlement is vetted by 50 separate state offices, the official said.

Now, there’s a lot that’s weird with this story, aside from the way it seemingly contradicted what Miller was saying to Congress at precisely the moment he was saying it. First, only three of the big servicers were mentioned in the story:

While there’s no universal agreement that would apply industry wide and the AGs are negotiating separately with each bank, many of the stipulations are the same for the agreements being discussed with the three largest mortgage servicers: Bank of America, JP Morgan Chase and Wells Fargo.

No mention of GMAC or Citi–or Goldman Sachs, which just announced a freeze on its foreclosures.

And this story reported that dual-track processing–in which people are being processed for modification at the same time they’re being foreclosed on–“should” stop.

They also agree that there should be no more “dual track” loan modification negotiations that end suddenly with foreclosures.

Yet at almost precisely the time when WaPo published this claim, BoA’s President of Home Loans, Barbara Desoer was explaining that they couldn’t end dual-track processing except on those loans BoA held on its own books and/or for loans that qualify for HAMP, and Chase’s CEO of Home Lending David Lowman was testifying that they wouldn’t end dual-track processing (he did suggest there was something Congress could do to give servicers safe harbor to end dual-track processing, but that he wouldn’t describe it in the hearing).

Then there’s the claim that there would be a compensation fund set up for those wrongly foreclosed.

The most radical part of the settlement deal has to do with providing monetary compensation for homeowners who have lost their homes but can prove that they have been foreclosed on wrongly. This is the most contentious item because the amount of the funds that would go into this have not been worked out and it’s also unclear how it would be administered.

At least the WaPo had the grace to suggest, without saying outright, that any such fund would be ripe for abuse by the banksters. The banks, after all, are often unable to give any real accounting of the amounts owned (and if they were able to, they’d be unwilling to show the illegal fees and accounting they were using). So how is a wrongly-foreclosed homeowner supposed to prove they were wrongly-foreclosed?

And then the article mentions nothing about modifications going forward. In other words, this “settlement” would achieve absolutely nothing–except for getting a bunch of banksters excused, again, for breaking the law. Not that I find that hard to believe. Just odd that WaPo wouldn’t mention that this alleged “settlement” wouldn’t accomplish the primary requirement of any “settlement:” fixing any problem but the legal liability of the banksters.

Mind you, I did note during the hearing that Miller didn’t seem to have consumers’ interests in minds when he was talking about any settlement, so I guess the outlined proposal is a possible one.

But most of all, note the big news in this story.

There is no mention of an investigation.

There was not a single soul at today’s hearing who claimed to have a good sense of the scope or reasons for the massive foreclosure fraud perpetrated by the banks. Indeed, almost everyone acknowledged the need for further investigation to make that clear.

That “investigation” was supposed to be conducted by the 50 AGs.

But if this article has even a shred of truth to it then the AG “investigation” is instead a fast-track effort not to “investigate” (god forbid, because you might actually expose how the banksters had ended private property and rule of law in the United States), but to find a way to get the banksters out of any accountability for their crimes.

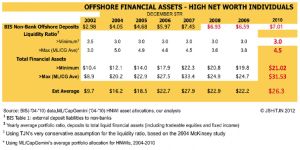

As I noted earlier, the Tax Justice Network just released a study showing that there is somewhere between $21 and 32$ Trillion that tax cheats have hidden in tax havens. Really obscenely rich people like Mitt Romney make up for $9.8 trillion of that–or about 18% of the total liquid net worth in the world, hidden away in tax havens.

As I noted earlier, the Tax Justice Network just released a study showing that there is somewhere between $21 and 32$ Trillion that tax cheats have hidden in tax havens. Really obscenely rich people like Mitt Romney make up for $9.8 trillion of that–or about 18% of the total liquid net worth in the world, hidden away in tax havens. But that’s sort of misleading. As the table above makes clear, the amount in tax havens grew by 67% between 2002 and 2004, then grew by 40% in the following two years, then by another 23% in the last year of the bubble. Then it crashed, basically losing that 23% and plateauing for a year. And then it started growing again, 18% between 2009 and 2010. And who knows how much in the last year?

But that’s sort of misleading. As the table above makes clear, the amount in tax havens grew by 67% between 2002 and 2004, then grew by 40% in the following two years, then by another 23% in the last year of the bubble. Then it crashed, basically losing that 23% and plateauing for a year. And then it started growing again, 18% between 2009 and 2010. And who knows how much in the last year?