Reviews of The Deficit Myth

Posts in this series

The Deficit Myth By Stephanie Kelton: Introduction And Index

Debunking The Deficit Myth

MMT On Inflation

Reflections On The Deficit Myth

The National Debt Is Soooooo Big

The Wonkish Myth Of Crowding Out

MMT On International Trade

Social Security And Other Entitlements

The last two chapters of Stephanie Kelton’s The Deficit Myth are focused on the real problems facing our economy and steps we can take to deal with them. These chapters show that thinking along the lines of Modern Monetary Theory is consistent with the goals of progressives, and that MMT can be applied to support working people and our society.

In this post, I look at some of the reviews of the book. I’ll start with this one from the Wall Street Journal by John H. Cochrane. [1] Cochrane begins with a complaint: what is MMT, it’s so confusing. Then he claims he wanted to learn logic and evidence supporting MMT. Maybe a professional economist shouldn’t look for technical descriptions in a book written for the general public. He then spins out a collection of weird stuff (she praises Kennedy for helping unions!) and misreadings (she doesn’t cite peer-reviewed papers, ignoring the footnotes).

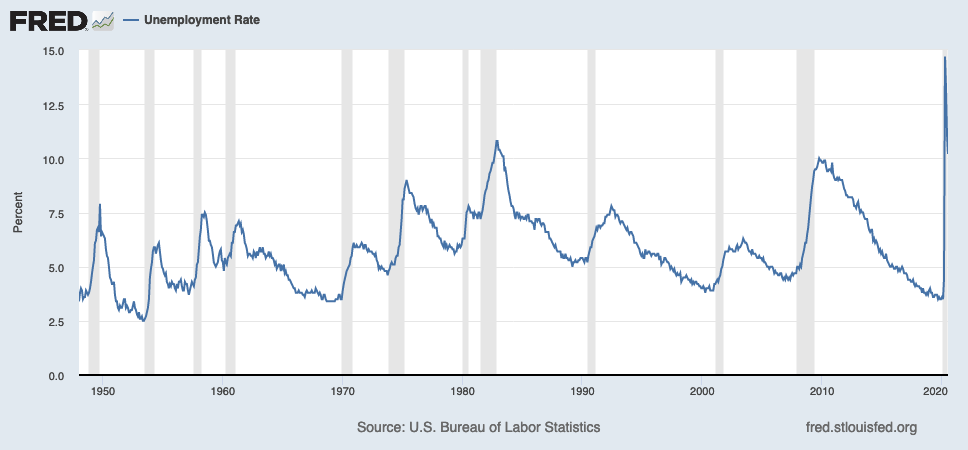

He admits that the government can print money to meet its needs. He understands Kelton’s insistence that the real constraint is inflation. But how will we know if there is slack in the economy or if we’ll get terrible inflation, he asks? He likes the concept of the Non-Accelerating Inflationary Rate of Unemployment. Kelton rejects NAIRU on the grounds that there is no such thing. Ignoring her reasoning, he sneers at her conclusion that NAIRU is a “… doctrine that relies on human suffering to fight inflation.” Here’s a chart showing the top-line unemployment rate from FRED:.

The gray bars represent recessions, most of which were caused by the Fed to fight inflation. The result is increased unemployment, which is solid evidence that Kelton is right.

He tries to make actual arguments:

“Taxes are there to create a demand for government currency.” This is a deep truth, which goes back to Adam Smith. Soaking up extra money with fiscal surpluses is, in fact, the ultimate control over inflation. But then arithmetic fails her. To avoid inflation, all the new money must eventually be soaked up in taxes. The new spending, then, is ultimately paid for with those taxes.

Well, not really. That’s why we have a national debt: it’s accounts for the actual wealth created by the government. We can raise or lower it as needed using taxes, all for the rational purpose of managing inflation. [2] There’s much more in the same vein, but that’s the flavor.

Here’s a generally laudatory review from Hans Desplain, a professor of political economy at Nichols College, in the London School of Economics blog. Despain recognizes that this is a book for lay people, and isn’t concerned about Kelton’s failure to address the ontology of money. [3]

Here’s one from the Mises Institute. The writer, Robert P. Murphy, is a senior fellow at the Mises Institute, a group focused on Austrian economics and libertarian political economy. He agrees with much of what Kelton says. His primary objection is this:

… [R]egardless of what happens to the “price level,” monetary inflation transfers real resources away from the private sector and into the hands of political officials.

“Monetary inflation” in this sentence means spending money without regard to tax revenues. Murphy’s concern is the violation of the principle that the private sector should allocate all resources, and any effort by the government to decide what society needs or wants is just bad. Another way to read this is that MMT is agnostic about government action. Kelton advocates forcefully for government action to amke people’s lives better. Murphy is on principle opposed to government spending. This is one of Kelton’s central points. We need to debate the allocation of resources as a society, and we do that through our democratically elected officials.

One final artical, this one by J. W. Mason in The American Prospect. Mason is an Assistant Professor of Economics at the John Jay College at CUNY. Based on his affiliations, he seems to be a progressive.

He points out that MMT is new, and therefore isn’t a polished structure of thought. It’s a “… ramshackle assemblage of parts built at different times for different purposes, tied together with loose solder of association and inference rather than tight bonds of deduction.” He accurately summarizes Kelton’s thesis and her solutions.

Mason disagrees with Kelton’s contention that all money comes from the government. He points out correctly that banks create money, and that Kelton does not address this point. I discussed a paper Kelton wrote on the nature of money here. She argues that money is a debt relationship, a matter of balance sheet entries, and discusses the superiority of this view to other theories. As Kelton says, quoting Randy Wray, “[m]oney is privately created when one party is willing to go into debt and another is willing to hold that debt….” [4]

In footnote 1 here, I briefly discussed the issue of bank-created money in MMT, based on this article by MMT economist Bill Mitchell. Mitchell says that banks do create money, but at the same time they create a liability, so the balance sheets of the bank and the borrower don’t change from the creation of money. When a government creates money it creates a liability on its books, and the consumer gets an asset. As I see it, the difference is that the government can decide to hold the liability forever while banks expect to be repaid promptly, which destroys the money created by the loan. Banks do lose money on loans, leaving the money in circulation, but that’s not supposed to happen. That’s one difference.

The second difference is the the government controls bank lending. It can limit or prevent banks from creating money through regulation of required reserves. Third, obviously the government has to consider bank-created money when addressing inflation. Finally, bank lending does not help in troubled times, when people don’t want to borrow. Right now, for example, personal savings are at a 60-year high, as people who still have jobe pay down debt and put off large purchases.

The ontology of money is way beyond the scope of Kelton’s book, but I do agree that at least bank-created money must be incorporated into the MMT framework more thoroughly. Edited to add this: Scott Fullwiller, an MMT economist at UKMC, commented below saying that MMT already incorporates bank-created money thoroughly. Fullwiller refers us to this post by Brian Romanchuk replying to Mason’s review.

Mason points out that this and other issues he raises don’t detract from the central insights of The Deficit Myth, saying that Kelton’s insights can stand alone and serve as a guide for action. This is a very useful review.

This is just a small sample, but it reveals one crucial thing: some serious people have begun to grapple with the actual arguments made by MMT theorists, and others will ignore the challenge MMT poses to conventional thinking, and defend their prejudices to the bitter ugly end.

=======

[Graphic via Grand Rapids Community Media Center under Creative Commons license-Attribution, No Derivatives]

[1] Here’s the link; it’s behind a paywall, but I got it from my library.

[2] Cochrane’s Wikipedia page has a section titled Main Contributions. It states his research interests, and then offers this assessment, loosely translated as “snicker”:

That is a standard general equilibrium logic, but many financial economists do not view it as a priority and prefer to explain prices without an ultimate reference to choices of households and firms. Similarly, many macroeconomists choose not to worry about asset prices.

In this vein, Cochrane’s work has been to document some empirical patterns and offer some potential explanation….

[3] The ontology of money is a real thing. You could look it up.

[4] Fun question: is bitcoin money? Who is on the opposite side of the balance sheet?