As you’ve surely heard, Mitt has finally released his tax return for 2011 along with a statement signed by Pricewaterhouse Coopers and certified by its General Counsel, Diana Weiss, summarizing what he paid for a 20 year span of time: 1990-2009.

Mitt’s campaign admitted this afternoon that he had paid more taxes than required this year to ensure he fulfilled an earlier statement that he always paid at least 13%. Had he deducted everything he could have, TPM figures, he’d have paid 12.2%. So we know what we’re seeing was manipulated for public consumption.

Greg Sargent tells us another way it was manipulated: by taking an average of the rate paid each year, rather than taking his total income and his total taxes and calculating that percentage. This has the effect of hiding the years when he paid almost no taxes on a whole lot of income.

Center for Tax Justice notes one reason this kind of average skews the PwC summary greatly.

Further, the summary provided by his lawyer is playing games by averaging Romney’s 20-year tax rate. Including the years 1992-97 skewed his rate upwards because during those years, the capital gains rate was 28 percent instead of the 15 percent it is now. If they’d averaged only the last 15 years, his rate would have been much lower.

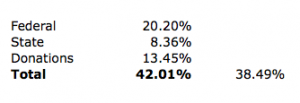

And we know that the averaging has skewed the tax rates. Consider the last bullet from the PwC letter:

Total federal income taxes owed, total state income taxes reported, and total donations deducted during the period represent 38.49% of your total adjusted gross income for the period.

You’d think, given the campaign’s admission they were just averaging the tax rates overall, this would be the sum of those averages. But it’s not:

If you add up those three average amounts, it equals 42.01%. Yet PwC admits that the total is actually just 38.49%–over 3.5% lower than the summed averages.

Furthermore, there seems to be more funny business going on here. That last bullet is not including like categories: it adds up “total income taxes owed,” “total state income taxes reported,” and “total donations deducted.” Why distinguish between what was (or is) owed at the federal level from what was reported at the state level?

That inconsistency of verbiage carries through to the base definitions earlier in the memo.

Each of the bullets defining the average–federal, state, and charitable deductions–takes the amount from “the federal income tax returns prepared during the period.” But when the memo confirms that the lowest rate Mitt ever paid was 13.66%, it refers to the “federal income tax returns as prepared,” without the “during the period” qualifier. This leaves open the possibility that Mitt has submitted some revised tax returns since that period–which ended in 2009. Given that there have been questions about Mitt’s residency, I wonder, too, why PwC didn’t take state amounts from state returns. Also, when the memo says “donations” in the last bullet, is it referring solely to charitable donations, or might it include gifts to his sons? Keep in mind, too, that it refers to amounts deducted, not amounts paid; Bain execs have long tithed stocks to the Mormon Church.

When TPM asked Mitt’s campaign whether they had amended earlier returns to come up with these results, they didn’t answer right away.

Did Romney artificially inflate his tax rate using the same strategy in other returns? That’s the biggest question raised by the disclosure of his move to take fewer deductions in 2011.

The Romney campaign did not immediately respond to questions over whether Romney amended any of his previous returns.

At the very least, the 2nd and the last bullets both allow for the possibility that Mitt’s federal returns have been changed. Indeed, when you consider Mitt’s rate before the change in capital gains had to have been far far higher, it may well allow for years when Mitt didn’t pay any federal taxes, but has since revised his returns to pay at least 13.66%.

And in any case, we know that the averages given skew his tax and donation rates by at least 3.5%.

Update: This post was modified for clarity.