As Government Releases Evidence of Systemic Mortgage Fraud, FBI Focuses on Distressed Homeowner Fraud

The Administration finally released the HUD Inspector General Reports that consist of the only investigation of foreclosure fraud conducted as part of the foreclosure settlement.

I’ll probably have more to say about the reports tomorrow. But here’s a hint. The Wells Fargo report describes WF management refusing almost all cooperation.

Wells Fargo provided a list of 14 affidavit signers and notaries and then initially restricted our access to interview them. Wells Fargo attorneys interviewed them first and then only allowed us to interview 5 of the 14 affidavit signers. Wells Fargo told us that we could not interview the others because they had reported questionable affidavit signing or notarizing practices when it interviewed them. After discussion with attorneys for Wells Fargo and OIG counsel, terms were agreed to, permitting us to interview these remaining nine persons. The terms that Wells Fargo set required that Wells Fargo management and attorneys attend all of the interviews as facilitators. This condition resulted in delays and may have limited the effectiveness of those interviews. Wells Fargo’s terms also required that persons we interviewed have private counsel present on their behalf. Wells Fargo chose the private counsel and paid the attorney fees of the persons we interviewed. Wells Fargo was not timely in arranging the private attorneys, which further delayed our interviews.

And it concludes that WF may have have violated the False Claims Act.

Based upon the results of our review, Wells Fargo’s practices may have exposed it to liability under the False Claims Act for submitting the claims for insurance benefits to FHA without following HUD requirements. We provided our preliminary findings to DOJ for its assessment and determination on any potential liability issues.

In other words, the government has been sitting on evidence of significant crime for the last 18 months–crime that resulted in people losing their homes and the government being defrauded.

The government just gave the banks a Get Out of Jail Free Card for those crimes.

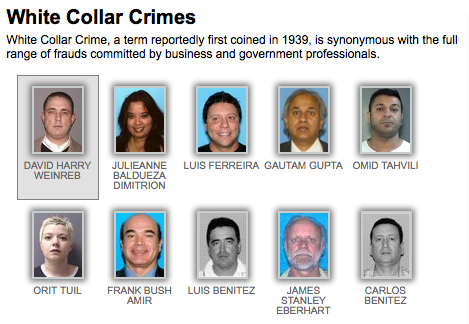

Meanwhile, here’s the financial fraud the FBI says it spent 2011 investigating, while DOJ sat on this evidence and the underlying frauds it clearly would lead to:

Mortgage fraud: During 2011, mortgage origination loans were at their lowest levels since 2001, partially due to tighter underwriting standards, while foreclosures and delinquencies have skyrocketed over the past few years. So, distressed homeowner fraud has replaced loan origination fraud as the number one mortgage fraud threat in many FBI offices. Other schemes include illegal property flipping, equity skimming, loan modification schemes, and builder bailout/condo conversion. During FY 2011, we had 2,691 pending mortgage fraud cases.

Financial institution fraud: Investigations in this area focused on insider fraud (embezzlement and misapplication), check fraud, counterfeit negotiable instruments, check kiting, and fraud contributing to the failure of financial institutions. The FBI has been especially busy with that last one—in FY 2010, 157 banks failed, the highest number since 181 financial institutions closed in 1992 at the height of the savings and loan crisis.

Distressed homeowner fraud, property flipping, and check kiting. That’s what the FBI has been looking at during the entire period when DOJ has just been sitting on this evidence of much greater, more destructive fraud.