Shorting the US-DPRK Meeting [UPDATED]

[NB: Update at the bottom. / ~Rayne]

At 5:08 pm ET / 7:08 am Tokyo / 6:08 am Shanghai / 1:08 am Moscow time, Trump tweeted:

Kim Jong Un talked about denuclearization with the South Korean Representatives, not just a freeze. Also, no missile testing by North Korea during this period of time. Great progress being made but sanctions will remain until an agreement is reached. Meeting being planned!

At 7:49 pm ET / 9:49 am Tokyo / 8:49 am Shanghai / 3:49 am Moscow time, Press Secretary Sanders tweeted:

.@POTUS greatly appreciates the nice words of the S. Korean delegation & Pres Moon. He will accept the invitation to meet w/ Kim Jong Un at a place & time to be determined. We look forward to the denuclearization of NK. In the meantime all sanctions & maximum pressure must remain

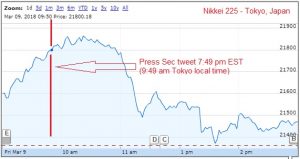

The stock market in Tokyo looked like this in response:

And Shanghai’s stock market looked like this:

Chinese investors have been bullish this week; the news about Trump meeting Kim Jong-un hasn’t really fazed them yet though if someone in the SSE Index knew about the announcement early enough, they could have made money shorting an index fund.

Japanese investors aren’t happy, which was predictable. It took them a bit to digest the news but they don’t appear comfortable. If someone knew about the announcement early enough, they could have made some money in the Nikkei using shorts.

Barring any other big news with international impact, I think we’ll see similar reactions as the sun rises over successive markets in the west. Again, somebody could probably make some money.

Call me cynical, but I think this anticipated US-North Korea meeting is just another means for making somebody cash.

Like investors with cash positions after dumping steel and aluminum bets last week — wouldn’t be surprised if they shorted Asian index funds overnight, and maybe EU and US funds in the morning local time.

UPDATE — 1:40 PM EST —

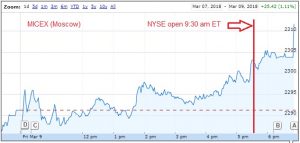

Note the markets at 9:30 am ET / 2:30 pm London / 3:30 pm Paris and Frankfurt / 5:30 pm Moscow time:

I proved I would be complete fail at shorting in US markets if I wasn’t immersed in market news; I missed the impending release of jobs data which skewed the NYSE. The FTSE (London), CAC 40 (Paris), and DAX (Frankfurt) all waited patiently to see what the NYSE would do on open. I suspect the difference between European market upticks and NYSE open time I’ve indicated is due to early trading in the U.S.; some brokerage accounts allow trades an hour or two before open.

In hindsight I wonder if the Hang Seng didn’t react like Tokyo because of a more closed market and less open media?

How interesting, though, that MICEX (Moscow) looked more like the Hang Seng throughout its day, hmm?

And imagine what one could do if they had advance indication of U.S. employment figures. If only all this was as harmless as watching Dan Akroyd and Eddie Murphy try to short orange juice futures on the CBOE in Trading Places (video excerpt, 1983).