To understand the new indictment against Hunter Biden, consider that the maximum penalty for all nine charges in Los Angeles, covering four years, is eight years less (17 total) than the maximum penalty for the three charges tied to 11 days of conduct in Delaware (25 years).

The charges, and penalties, look like this:

- Failure to pay 2016 (1)

- Failure to pay 2017 (1)

- Failure to file 2017 (1)

- Failure to pay 2018 (1)

- Failure to file 2018 (1)

- Tax evasion 2018 (5)

- False return 2018 (3)

- False return 2018 (3)

- Failure to pay 2019 (1)

The LA indictment isn’t really about four years of conduct. It’s about the tax forms filed — ultimately in 2020 — for one year: 2018, the year of Hunter’s most desperate addiction (and also, as it happens, the year when this investigation began and a year when a bunch of people, including the then-President, his personal attorney, and some Russian spies — started targeting Hunter as a political ploy).

All the other charges are misdemeanor charges that would never be filed — especially not with someone who ultimately did pay the taxes — absent the felony charges tied to 2018.

But I suspect Weiss chose to include those charges — including for 2016, a year that not even the disgruntled IRS agents were always sure should be charged — to make the package as a whole sustainable.

The 2018 allegations

The 2018 allegations aren’t controversial (indeed, they are the ones that Joseph Ziegler has been detailing over and over).

Basically, Weiss is charging Hunter Biden for lying in 2020 to limit the taxes he had to pay on his still-substantial 2018 income that he blew on sex workers and cocaine.

Weiss alleges that when Hunter went over his finances with what happened to be a new tax accountant in 2019 and 2020, he told the accountant that payments to four women — one of whom is the mother of his fourth child, Lunden Roberts — and a bunch of travel expenses and payments to his kids were instead business expenses.

Here are some of the expenses that Weiss’ prosecutors will show — in the middle of a Presidential campaign — that Hunter wrote off as business expenses:

a. Claiming false “Travel, Transportation and Other” deductions including, but not limited to, luxury vehicle rentals, house rentals for his then-girlfriend, hotel expenses, and New York City apartment rent for his daughter;

b. Claiming false “Office and Miscellaneous” deductions, including, but not limited to, the purchase of luxury clothing, payments to escorts and dancers, and payments for his daughter’s college advising services;

c. Claiming false “Legal Professional and Consulting” deductions, including, but not limited to, payment of his daughter’s law school tuition and his personal life insurance policy;

d. Claiming false deductions for payments from Owasco, PC’s account to pay off the business line of credit, specifically by allocating 80 percent to “Travel Transportation and Other” and 20 percent to “Meals,” when in truth and in fact most of the business line of credit expenses were personal, including to a website providing pornographic content, payments at a strip club, and additional rent payments for his daughter; and

e. Claiming false deductions for payments from Owasco, PC’s account to JP Morgan Chase, specifically that these were for “consulting,” when in truth and in fact, these transfers included payments to various women who were either romantically involved with or otherwise performing personal services for the Defendant, including a $10,000 payment for his membership in a sex club.

To prove that Hunter deliberately lied on his 2018 tax returns, Weiss will have to prove that in a series of meetings with his accountant in 2020, Hunter affirmatively chose not to highlight certain expenses as personal expenses — including that $10,000 payment for membership in a sex club.

117. On January 28, 2020, the Defendant met with the CA Accountants in person at their office for more than three hours. During this meeting the Defendant reviewed the General Ledger and various schedules for Owasco, PC including a purported “Office Expense” schedule and a purported “Professional and Outside Service” schedule to confirm their accuracy.

[snip]

120. While he reviewed the schedules for “Office Expenses” and “Professional and Outside Services,” the Defendant affirmatively identified, with a yellow highlighter, personal expenses that should not be deducted as business expenses.

121. While the Defendant identified personal expenses on the “Office Expense” Schedule, including ones as small as a $15 payment to a tattoo parlor and a $35.56 payment to a bookstore, he did not identify the following personal expenses:

a. A $1,500 Venmo payment on August 14, 2018. That payment was to an exotic dancer, at a strip club. The Defendant described the payment in the Venmo transaction as for “artwork.” The exotic dancer had not sold him any artwork.

Weiss will have to prove that Hunter reviewed those expenses, remembered what they were, and nevertheless did not highlight them as personal expenses.

Weiss will be helped (as he will in the Delaware case), enormously, by Hunter’s decision to write all this up.

And the Defendant specifically described his stays in various luxury hotels in California and private rentals, and expenses related to them, in this way:

I stayed in one place until I tired of it, or until it tired of me, and then moved on, my merry band of crooks, creeps, and outcasts soon to follow. Availability drove some of the moves; impulsiveness drove others. A sample itinerary: I left the Chateau [Marmont] the first time for an Airbnb in Malibu. When I couldn’t reserve it for longer than a week, I returned to West Hollywood and the Jeremy hotel. There were then stays at the Sunset Tower, Sixty Beverly Hills, and the Hollywood Roosevelt. Then another Airbnb in Malibu and an Airbnb in the Hollywood Hills. Then back to the Chateau. Then the NoMad downtown, the Standard on Sunset. A return to the Sixty, a return to Malibu . . . An ant trail of dealers and their sidekicks rolled in and out, day and night. They pulled up in late-series Mercedes-Benzes, decked out in oversized Raiders or Lakers jerseys and flashing fake Rolexes. Their stripper girlfriends invited their girlfriends, who invited their boyfriends. They’d drink up the entire minibar, call room service for filet mignon and a bottle of Dom Pérignon. One of the women even ordered an additional filet for her purse-sized dog.

Notably, the Defendant did not write that he conducted any business in any of these luxury hotels nor did he describe any of the individuals who visited him there as doing so for any business purpose.

But Weiss will also have to prosecute this case in a way that is consistent with his prior decision to offer Hunter a plea agreement, which doesn’t also substantiate the disgruntled IRS agents’ claims of bias. Weiss has to be prepared to a tell a story that is consistent with his prior decision to offer a plea agreement here.

The challenges

To understand that tension, it helps to think about why Weiss may not have charged Hunter with felonies in the first place.

There’s no reason to believe it was bias. Indeed, the media and dick pic sniffing tour created by Ziegler and Jim Jordan have revealed that DOJ Tax attorneys weren’t entirely thrilled with the charges. And there’s good reason to believe that career prosecutors in Los Angeles advised US Attorney Martin Estrada it was a weak case; since Jordan insisted on Estrada providing testimony to HJC, Hunter might even succeed at obtaining the three memos that prosecutors provided to Estrada in advance of his decision not to join the case.

Career attorneys didn’t think it would be a sure thing to prosecute this case.

There are at least five things that make it hard.

First, as noted, Hunter was working with a new accountant starting in 2019. His prior accountant died in June 2019, within weeks of Hunter getting sober, and he didn’t get a new accountant for five months.

The Defendant used the services of D.C. Accountant from January 1, 2017, until D.C. Accountant’s death in or about June 2019. In November 2019, the Defendant engaged the services of an accounting firm in Los Angeles, California (hereafter the “CA Accountants”).

To make that process more difficult, Hunter didn’t have solid records for 2018, and so his accountants had to reconstruct things from bank and credit card receipts.

While D.C. Accountant had already created financial and accounting records in connection with the 2017 tax returns, no similar records existed for 2018. Therefore, the CA Accountants used available bank and credit card statements to create various schedules, including schedules for different categories of expenses, and a general ledger for Owasco, PC.

The indictment makes much of the fact that Hunter didn’t share the book with the accountants, but that’s not a crime (or that unusual).

Then, most obviously, there’s the addiction. Weiss will have to prove that when Hunter did not exclude personal expenses as personal expenses, he had an affirmative knowledge of what particular expenses were. In some ways, Hunter’s book helps him here — in it, he describes that everything was a blur.

Plus, everyone involved believed that a jury would be sympathetic to a recovering junkie who fucked up his taxes in the first full year he was sober. While prosecutors are likely to be able to exclude some of the evidence that this entire investigation was a political hit job, Hunter’s attorneys will surely be able to play to the sympathies of Democratic jurors for Hunter’s father.

And whereas in some venues, the sheer extravagance of Hunter’s expenses — the decision to blow $1,727 in April 2018 on a Lamborghini until his Porsche was shipped out — might turn off jurors, this is LA. At least some jurors might not find such extravagances offensive in the way that they would in other areas.

You only need one.

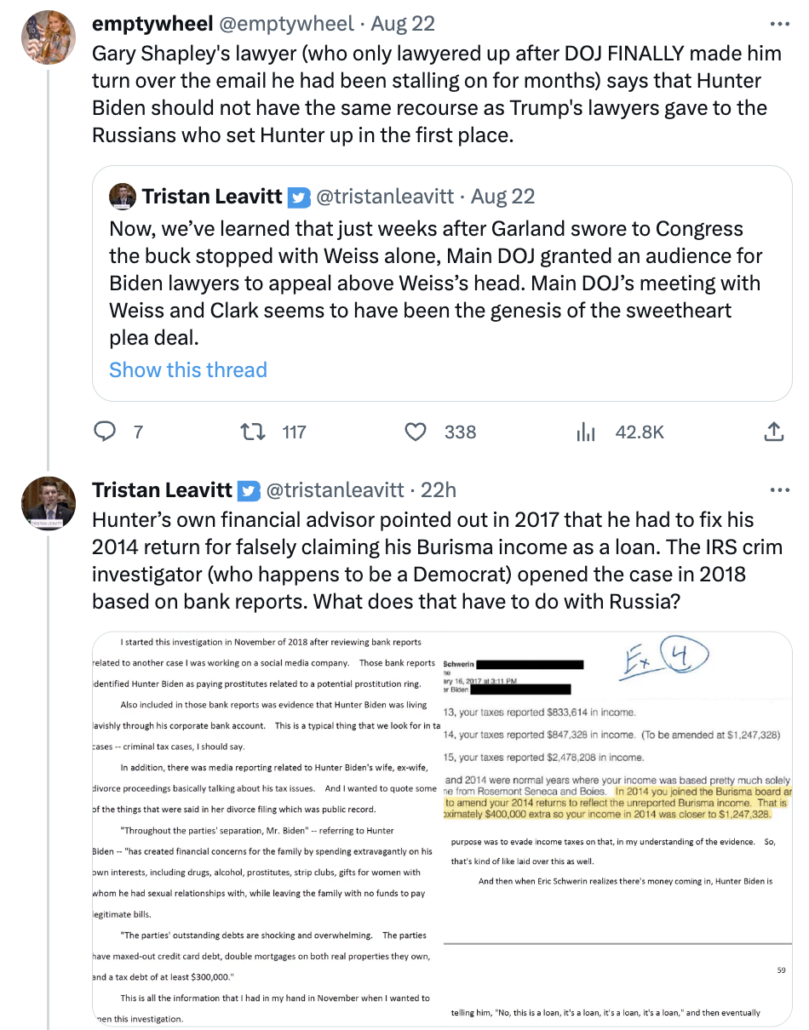

And all that’s before you consider the general difficulties of this case. Ziegler testified that when he opened this case, he had nothing but payments to sex workers and public divorce complaints. What he used to get beyond that was a claim that Hunter deliberately hid his Burisma income in 2014 — a claim not backed by this indictment (which says that the money instead went into the joint business Hunter had with Devon Archer). Ziegler’s supervisor documented improper political influence at least from the then-President, and likely others. As I have described, it’s not clear whether Delaware ratcheted up this investigation before Ukrainians pitched what was a likely influence operation. And for the entirety of 2019, Trump partisans — including one who accepted something that might be an envelope from the then-President — kept attempting to tamper in this investigation. One thing Abbe Lowell has been assiduously doing is documenting the people who may have committed crimes in an effort to ensure his client would be prosecuted — people like Tony Bobulinski and Rudy Giuliani. Even ignoring the October 2022 leak to the WaPo (which I don’t think can directly be attributed to Shapley or Ziegler), Lowell does have a real claim that Zielger and Gary Shapley shared grand jury information in an effort to force Weiss to charge this. As Lowell described in his subpoena request, if he can prove that Trump spoke to anyone in the IRS about this case, Trump, too, would be among those who committed a crime, 26 USC 7217, in an effort to see his client charged.

Lowell has a real case that DOJ chose to ignore the crimes of up to seven people, including Donald Trump, to pursue this prosecution against his client.

Some of the witnesses against Hunter will be his old business partners — though those same people will attest to how debilitating his addiction was. A critical witness will be James Biden, the President’s brother. Others, however, will be people who can easily be impeached as political partisans or disgruntled ex-wives. At this point, Lowell might even be able to call Ziegler to discredit the case Ziegler built.

All those difficulties explain why David Weiss might have decided in May 2023 that it would be a just resolution to get Hunter to plead guilty to misdemeanor charges covering just 2017 and 2018, along with a diversion agreement for the gun charge.

The reneged plea deal

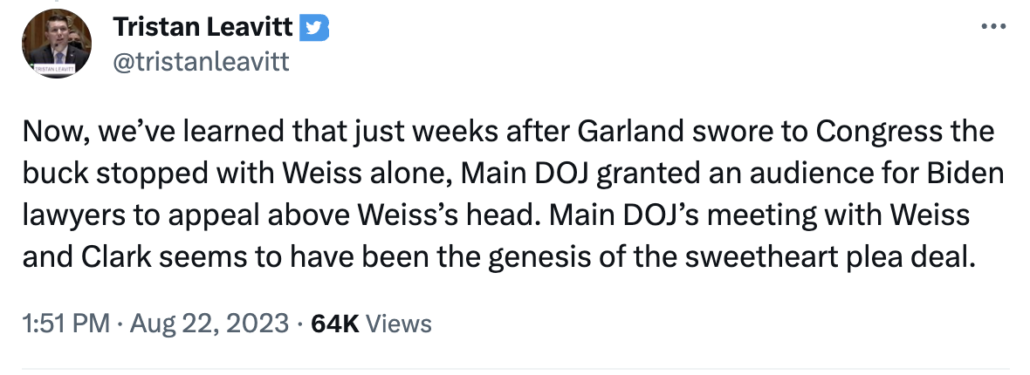

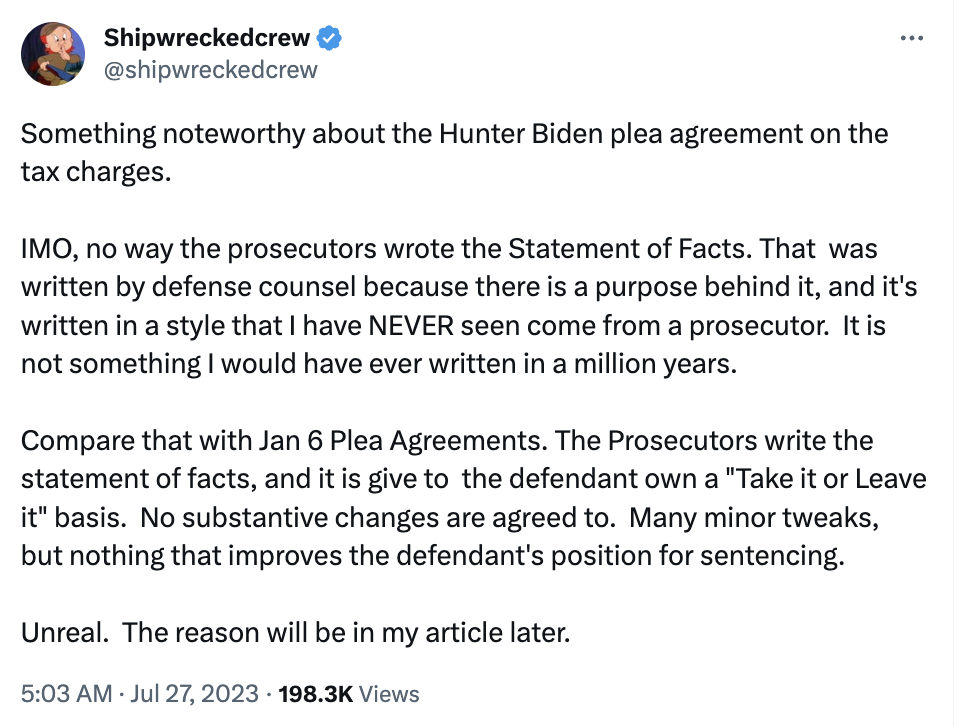

David Weiss reportedly decided in May 2023 that it would be a just resolution to plead this out. By June 20, though, when he surprised Chris Clark by stating the investigation was ongoing, he may have changed his mind.

Particularly given the six misdemeanor charges for which no one else would be charged and the like comparators of Roger Stone, this indictment will face the same challenges that the Delaware one will: selective prosecution at least for those misdemeanor charges and vindictive prosecution for the decision to charge an indictment holding a 17-year criminal exposure months after claiming to offer a misdemeanor plea. As I’ve described, selective and vindictive prosecution claims are virtually impossible to show, but this case also includes unprecedented aspects that might make this case different.

While malicious prosecution claims are normally just as impossible as selective and vindictive ones, Shapley and Ziegler have given Lowell abundant basis to at least try to make that claim, particularly given that Weiss didn’t allege the criminal wrong doing in 2014 that Shapley and Ziegler have made their white whale.

Finally, there is the claim (possibly to be made as part of a vindictive prosecution claim) that Weiss reneged on a plea deal, by offering a resolution to all charges but then claiming the investigation was ongoing.

Jordan’s efforts help again, here — not just because his efforts do provide a plausible claim of political pressure, but because of the testimony he has demanded.

When describing the threats that he and members of his team started experiencing around the time that — Lowell has claimed — he reneged on a plea deal, David Weiss used the word “intimidate.”

Q Has the outsized attention given to this case resulted in threats and harassment against members of your office?

A Yes. Members of my office, agents assigned to the case, both from the IRS and from the FBI, doxing family members of members of my office. So, yeah, it’s part and parcel of this case.

Q Do you have concerns for the safety of individuals working in your office?

A I really can’t speak to the intention of any actor in this realm. I just know that these — that certain actions have been taken by individuals, doxing, and, you know, threats that have been made, and that gives rise to concern. We’ve got to be able to do our jobs. And, sure, people shouldn’t be intimidated, threatened, or in any way influenced by others who — again, I don’t know what their motives are, but we’re just trying to do a public service here, so —

Q Have you yourself been the subject of any threats or harassment?

A I’ve certainly received messages, calls, emails from folks who have not been completely enamored of my — with my role in this case. [my emphasis]

As Lowell noted in his subpoena request, the former President — who Judge Engoron and Jack Smith’s prosecutors have both shown deliberately incites his followers to generate threats against his adversaries — has made at least four such posts in the period when Weiss was deliberating over what to do.

D. Trump Truth Social posts on June 20, 2023:

- “Wow! The corrupt Biden DOJ just cleared up hundreds of years of criminal liability by giving Hunter Biden a mere ‘traffic ticket.’ Our system is BROKEN!”

- “A ‘SWEETHEART’ DEAL FOR HUNTER (AND JOE), AS THEY CONTINUE THEIR QUEST TO ‘GET’ TRUMP, JOE’S POLITICAL OPPONENT. WE ARE NOW A THIRD WORLD COUNTRY!”

- “The Hunter/Joe Biden settlement is a massive COVERUP & FULL SCALE ELECTION INTERFERENCE ‘SCAM’ THE LIKES OF WHICH HAS NEVER BEEN SEEN IN OUR COUNTRY BEFORE. A ‘TRAFFIC TICKET,’ & JOE IS ALL CLEANED UP & READY TO GO INTO THE 2024 PRESIDENTIAL ELECTION. . . .”

D. Trump Truth Social post on July 11, 2023: “Weiss is a COWARD, a smaller version of Bill Barr, who never had the courage to do what everyone knows should have been done. He gave out a traffic ticket instead of a death sentence. Because of the two Democrat Senators in Delaware, they got to choose and/or approve him. Maybe the judge presiding will have the courage and intellect to break up this cesspool of crime. The collusion and corruption is beyond description. TWO TIERS OF JUSTICE!”

David Weiss wasn’t going to charge Hunter with a felony on the tax charges. Then Donald Trump got involved, and Weiss and his team started getting intimidating messages, and he decided he would.

That’s a pretty compelling — and unprecedented — due process claim.

Hunter’s former attorneys

One way Weiss tries to prove his case otherwise is his inclusion of 2019 — one of the misdemeanor charges — in the indictment.

After he got sober, the indictment alleges, Hunter still didn’t pay his taxes.

As the charge tied to 2019 describes, Hunter filed taxes in October 2020, but didn’t pay them off, presumably until 2021, when Kevin Morris paid off his remaining tax debt.

D. The Defendant owed taxes for 2019, which he chose not to pay.

156. The Defendant filed a 2019 From 1040 on October 15, 2020, and self-reported that he earned total gross income of $1,045,850 and taxable income of $843,577 and self-assessed that he owed $197,372 for the 2019 tax year.

157. The Defendant did not pay any of his outstanding tax debt when he filed his return.

E. The Defendant had the funds available to pay his taxes.

158. In 2020, prior to when the Defendant filed the 2019 Form 1040, the Defendant’s agent received multiple payments from the publisher of his memoir and then transferred the following amounts to the Defendant’s wife’s account in the amounts and on the dates that follow:

a. $93,750 on January 21, 2020; and

b. $46,875 on May 26, 2020.

F. Rather than pay his taxes, the Defendant spent millions of dollars on an extravagant lifestyle.

159. From January through October 15, 2020, the Defendant spent more than $600,000 on personal expenses rather than pay any of the $197,372 he owed for tax year 2019.

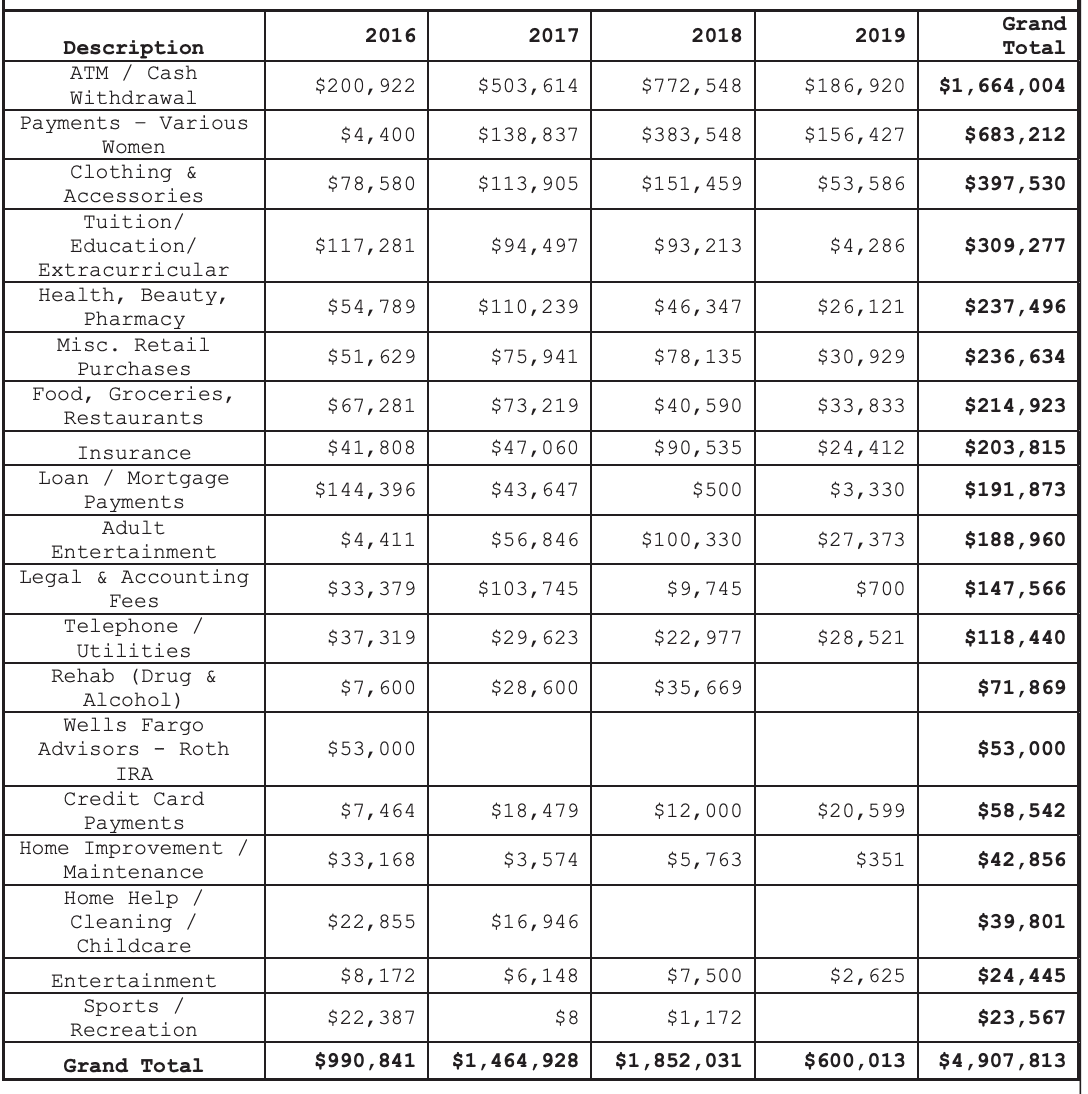

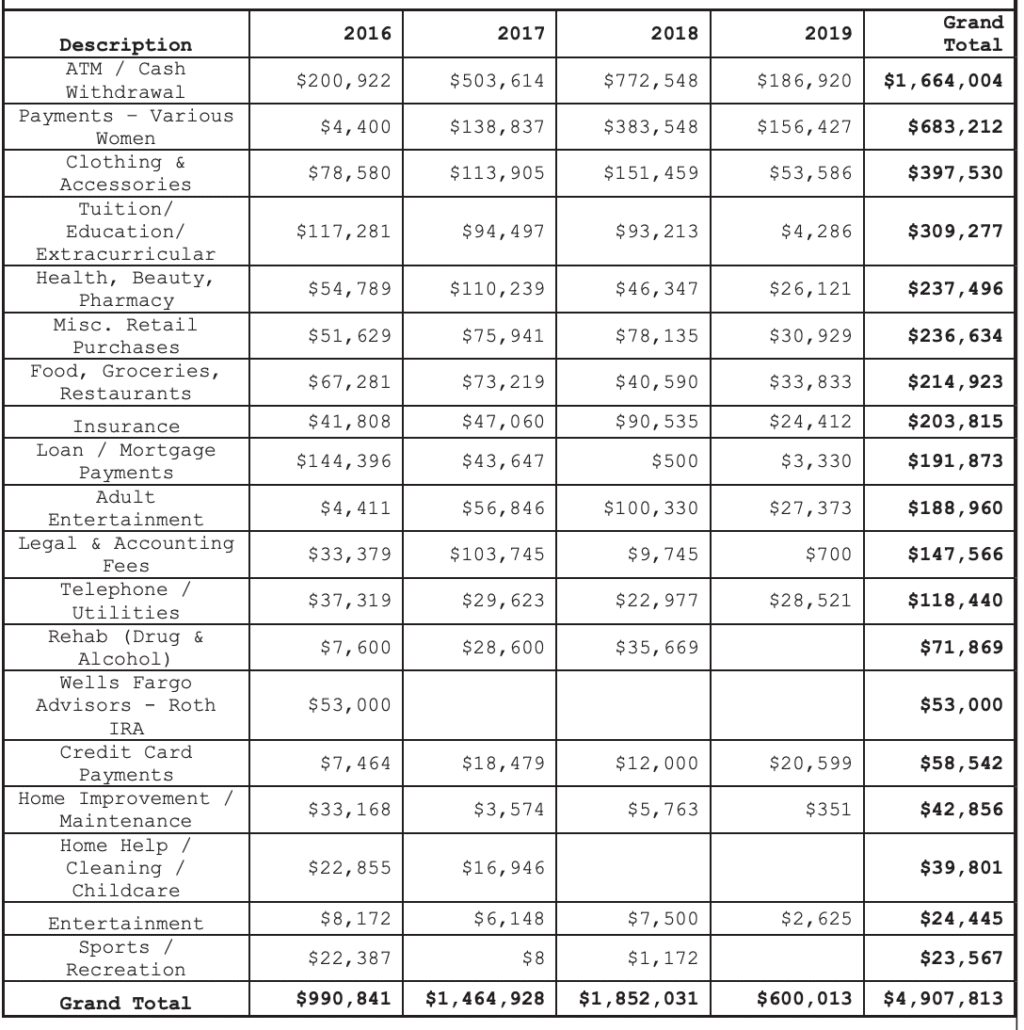

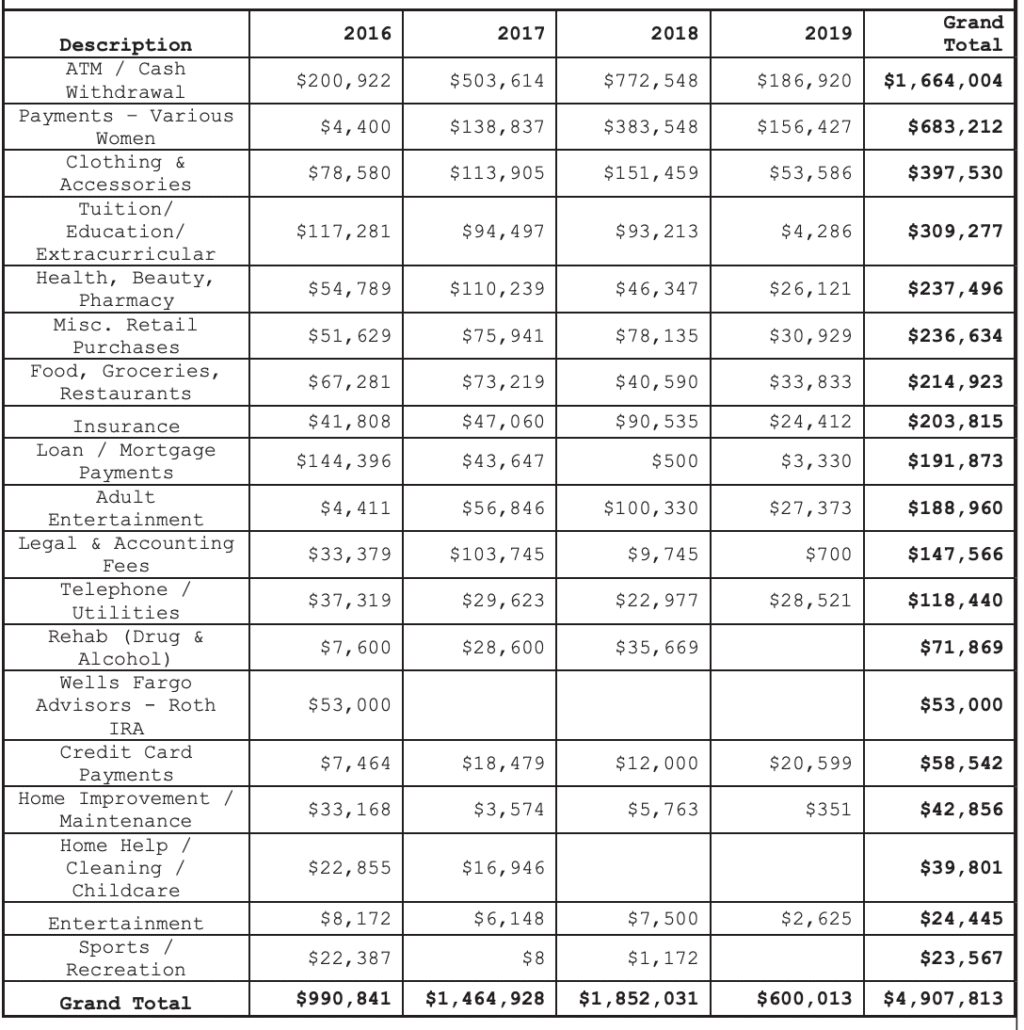

This is, in my opinion, a necessary but also the weakest part of the indictment. The table Weiss includes showing where Hunter blew his money shows his expenses dropped already in 2019 (during just half of which year he was sober), and it doesn’t include 2020 at all.

Instead, Weiss includes this paragraph, showing that Kevin Morris paid for Hunter’s rent and his car, which happened to be a Porsche.

17. From January through October 15, 2020, an entertainment lawyer (hereafter “Personal Friend”) provided the Defendant with substantial financial support including approximately $200,000 to rent a lavish house on a canal in Venice, California; $11,000 in payments for his Porsche; and other individual items. In total, the Defendant had Personal Friend pay over $1.2 million to third parties for the Defendant’s benefit from January through October 15, 2020.

[snip]

Notably, in 2020, well after he had regained his sobriety, and when he finally filed his outstanding 2016, 2017, and 2018 Forms 1040, the Defendant did not direct any payments toward his tax liabilities for each of those years. At the same time, the Defendant spent large sums to maintain his lifestyle from January through October 15, 2020. In that period, he received financial support from Personal Friend totaling approximately $1.2 million. The financial support included hundreds of thousands of dollars in payments for, among other things, housing, media relations, accountants, lawyers, and his Porsche. For example, the Defendant spent $17,500 each month, totaling approximately $200,000 from January through October 15, 2020, on a lavish house on a canal in Venice Beach, California.

Much of those third party expenditures, I imagine, went to Hunter’s ex wife and to child support for his fourth child. Particularly given that Morris did pay off the taxes, this is a complaint that that happened in 2021 and not 2020.

So a great deal of Weiss’ case depends on convincing jurors that that $17,500 lavish house on the canal is corrupt. Why didn’t the President’s son sell the Porsche and buy a Honda, prosecutors will ask, so he could at least start paying off his taxes due?

Undoubtedly, Weiss is banking on such claims being politically impossible during a Presidential election. To take this to trial, Hunter Biden has to be willing to let a paparazzi press spend valuable campaign reporting time on how a person can spend $383,548 on sex workers and $100,330 on adult entertainment in one year, 2018. It risks making the 2024 campaign precisely what Rudy Giuliani intended the 2020 one to be.

But there’s one other thing that, I think, Weiss plans to use to ensure he can bring this case.

Thus far, the indictment only alleges that Hunter lied to the accountant who did his 2018 taxes. But depending on what Lowell does over the weekend, it may make it easier for Weiss to claim that Hunter lied, in 2022, to his attorneys.

In June 2022, one of Hunter’s attorneys wrote Mark Daly — a DOJ tax prosecutor — and described that if he were to testify, Hunter would claim to have engaged in five different kinds of business in 2018. Two of those paragraphs are redacted in the version Joseph Ziegler released. Ziegler has suggested that one includes a woman with whom he was sleeping (who is undoubtedly one of the four women described as have been on Owasco’s payroll in 2018). Another includes a guy who may have been his dealer.

The third unredacted paragraph describes residual meetings involving Hudson West — meetings in which his uncle James Biden was involved.

Throughout the beginning of 2018, Mr. Biden recalls working extensively on ventures related to Hudson West III, including on a potential investment in a project at Monkey Island. Meetings and interactions related to Hudson West III took place with, among others, James Biden, Jiaqi Bao, Mervyn Yan, and Gongwen (Kevin) Dong, including (via teleconference) in March 2018. Mr. Biden also evaluated several business ventures with Mr. Schwerin and James Biden throughout 2018. These efforts involved several in‐person meetings with James Biden, including we understand in Washington, D.C., Philadelphia, and New York. We understand that ventures that were evaluated by Mr. Biden in the context of these meetings included one venture to expand an insurance business into Los Angeles, and another related to development of treatment centers on the west coast for substance abuse programs.

In his September 2022 interview — and, I have no doubt, in the President’s brother’s recent grand jury appearance — James Biden said he wasn’t involved in any business deals with Hunter in 2018.

James B stated that he recalled not being involved with anything beyond 2017. James B stated that he wanted a “soft landing” for RHB.

I think it exceedingly likely that Weiss will threaten to argue (if he hasn’t already gotten crime-fraud excepted testimony), that Hunter lied to his attorneys in 2022 about his ongoing business efforts in 2018. Obtaining a crime-fraud exception (from the Chief Judge in Los Angeles, probably) would have required fewer, if any, approvals as Special Counsel.

Abbe Lowell has been promising for months that he plans to argue that David Weiss reneged on a diversion agreement and plea in the summer — at a time, Weiss has since testified, he and his team were getting “intimidat[ing]” messages. But central to that plan has always been getting Chris Clark to testify about what Weiss and Lesley Wolf promised in May 2023.

Weiss may have already gotten testimony from Hunter’s former lawyers. Or, Weiss may imagine that the attorney-client waiver required to get Clark’s testimony about how he reneged on the plea deal will make it easier — if not provide a venue — to ask Clark about what Hunter said that led Clark to offer that proffer last summer.

But Lowell’s vindictive prosecution claim is due on Monday. Weiss indicted this case on the last grand jury day possible before that vindictive prosecution claim (not to mention any legal action in advance of Hunter’s compelled testimony before Congress on Wednesday).

To rebut a vindictive prosecution claim, David Weiss will need proof about what changed. And one thing that may have changed, with the grant of Special Counsel status, is to make it easier to obtain a crime-fraud exception for Hunter’s former attorneys.