My mom’s pretty stubborn (I come by it naturally). So in spite of the fact that I have been warning her to move her primary banking out of Bank of America into a solvent bank for over a year, she has yet to do so.

Which is why I’m so troubled that Bank of America is about to use my mom’s savings to back its derivatives counterparties.

Bank of America Corp. (BAC), hit by a credit downgrade last month, has moved derivatives from its Merrill Lynch unit to a subsidiary flush with insured deposits, according to people with direct knowledge of the situation.

The Federal Reserve and Federal Deposit Insurance Corp. disagree over the transfers, which are being requested by counterparties, said the people, who asked to remain anonymous because they weren’t authorized to speak publicly. The Fed has signaled that it favors moving the derivatives to give relief to the bank holding company, while the FDIC, which would have to pay off depositors in the event of a bank failure, is objecting, said the people. The bank doesn’t believe regulatory approval is needed, said people with knowledge of its position.

Money’s fungible, right? That’s what the anti-choice people say, anyway. So what’s the big deal that BoA has taken Merrill Lynch’s exposure to the European mess and put that risk where mom keeps her retirement? Yves Smith explains. First, this will make it all-but-impossible to unwind Bank of America when it goes under without disrupting the personal accounts of people like my mom. Significantly, if those derivatives pay off (for example, if Greece defaults) or require more collateral (because BoA gets downgraded again), then counterparties would get their money before mom does.

The reason that commentators like Chris Whalen were relatively sanguine about Bank of America likely becoming insolvent as a result of eventual mortgage and other litigation losses is that it would be a holding company bankruptcy. The operating units, most importantly, the banks, would not be affected and could be spun out to a new entity or sold. Shareholders would be wiped out and holding company creditors (most important, bondholders) would take a hit by having their debt haircut and partly converted to equity.

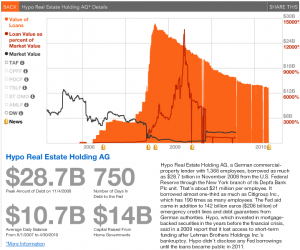

This changes the picture completely. This move reflects either criminal incompetence or abject corruption by the Fed. Even though I’ve expressed my doubts as to whether Dodd Frank resolutions will work, dumping derivatives into depositaries pretty much guarantees a Dodd Frank resolution will fail. Remember the effect of the 2005 bankruptcy law revisions: derivatives counterparties are first in line, they get to grab assets first and leave everyone else to scramble for crumbs. So this move amounts to a direct transfer from derivatives counterparties of Merrill to the taxpayer, via the FDIC, which would have to make depositors whole after derivatives counterparties grabbed collateral. It’s well nigh impossible to have an orderly wind down in this scenario. You have a derivatives counterparty land grab and an abrupt insolvency. Lehman failed over a weekend after JP Morgan grabbed collateral. [Yves’ emphasis]

As Yves points out, this will quickly result in the depletion of FDIC’s deposit insurance to pay my mom back for the money the banksters snatched. She suggests that Congress will quickly vote to fund the Treasury so it can pay my mom–and millions of other Americans–to replace their insured funds.

But it’s even worse than that. During the savings & loan crisis, the FDIC did not have enough in deposit insurance receipts to pay for the Resolution Trust Corporation wind-down vehicle. It had to get more funding from Congress. This move paves the way for another TARP-style shakedown of taxpayers, this time to save depositors. No Congressman would dare vote against that. This move is Machiavellian, and just plain evil.

She’s probably right that even the most Do-Nothing Congress in American history will eventually fund Treasury. I’m just not convinced it’ll happen quickly, or without some really big hostages demanded, first.

Now, mom’s in pretty decent shape for a retiree–between some pensions and other retirement funds, she could wait out the Do-Nothing Congress. And heck, I’m even willing to lend mom a few bob, even if she is so stubborn.

But most Americans are living paycheck to paycheck, and millions of them depend on what they’ve got deposited in Bank of America. It seems to me that Ben Bernanke has just unilaterally decided to make those BoA depositers lend banksters their life savings until such time as the Do-Nothing Congress gets around to fixing what are, as we speak, foreseeable and unacceptable consequences of this move.

Update: Jeebus I had a lot of typos in this. I hope I’ve gotten them all.