Is This the Missing WikiLeaks PayPal Order?

As I noted in this post, the declaration submitted in EFF’s FOIA for Section 215 by ODNI’s Jennifer Hudson is remarkably revealing. I’m particularly intrigued by these comments about the financial dragnet order released on March 28.

A FISC Supplemental Order in BR 10-82, dated November 23, 2010 and consisting of two pages, has been withheld in part to protect certain classified and law enforcement sensitive information. The case underlying BR 10-82 is an FBI counterterrorism investigation of a specific target. That investigation is still pending. Here, in the course of a pending counterterrorism investigation, the FBI sought authorization under the FISA to obtain financial records, under the FISA’s business records provision, pertaining to the target of the investigation and in fact obtained such authorization.

[snip]

Here, in the course of a pending counterterrorism investigation, the FBI sought authorization under the FISA to obtain certain financial records. The FISC Supplemental Order, which was issued in relation to its authorization for such collection, was thus compiled for law enforcement purposes, in furtherance of a national security investigation within the FBI’s authorized law enforcement duties.

[snip]

Here, the FBI has determined that the release of the final paragraph of the order, which describes certain requirements reflecting the FBI’s particular implementation of the authority granted by the FISC, could reasonably be expected to adversely impact the pending investigation and any resulting prosecutions. Release of this paragraph would reveal the specific and unique implementation requirements imposed on the FBI under this FISA-authorized collection during a particular time period. It is unclear what and how much the target might already know about the FBI’s investigation. However, as more fully explained in my classified ex parte, in camera declaration, there is reason to believe that the target or others knowledgeable about the nature and timing of the investigation could piece together this information, the docket number, the dates of the collection, and other information which has already been released or deduced to assemble a picture that would reveal to the target that the target was the subject of a particular type of intelligence collection during a specific time period, and by extension, that the target’s associates during that period may have been subject to similar intelligence collections. This could lead the target to deduce the scope, focus, and direction of the FBI’s investigative efforts, and potentially any gaps in the collections, from which the target could deduce times when the target’s activities were “safe.” [my emphasis]

The bolded section says that certain people — the target, but also “others knowledgeable about the nature and timing of the investigation” — could put the financial dragnet request together with other information released or deduced to figure out that the target and his associates had had their financial data collected.

Gosh, that’s like waving a flag at anyone who might be “knowledgeable about the nature of the investigation.”

What counterterrorism investigation has generated sufficient attention such that not only the target, but outsiders, would recognize this order pertains the investigation in question? The investigation would be:

- A counterterrorism investigation

- In relatively early stages on November 23, 2010

- Used financial records in a potentially novel way, perhaps to identify affiliates of the target

- Still going on

The CIA & etc. Money Order Orders

One obvious possibility is the generalized CIA investigation into Western Union and international money transfers reported by WSJ and NYT last year. While both stories said the CIA got these orders, I suggested it likely that FBI submitted the orders and disseminated the information as broadly as FBI’s information sharing rules allowed, not least because CIA has no analytical advantage on such orders, as NSA would have for the phone dragnet.

There are two reasons this is unlikely. First, there’s the timing. The WSJ version of the story, at least, suggested this had been going on some time, before 2010. If that’s the case, then there’s no reason to believe a new order in 2010 reviewed this issue. And while I don’t think the 2010 order necessarily indicates the first financial 215 order (after all, it took 2.5 years before FISC weighed the equivalent question in the phone dragnet), it is unlikely that this order comes from an existing program.

That’s true, too, because this seems to be tied to a specific investigation, rather than the enterprise counterterrorism investigation that underlies the phone dragnet (and presumably the CIA program). So while this practice generated enough attention to be the investigation, I doubt it is.

The Scary Car Broker Plot

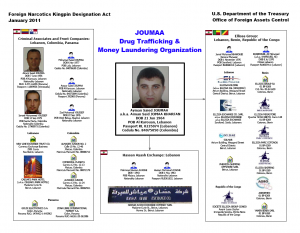

Then there’s what I call the Scary Car Broker Plot, which I wrote about here. Basically, it’s a giant investigation into drug trafficking from Colombia through Western Africa that contributes some money to Hezbollah and therefore has been treated as a terror terror terror investigation when in reality it is a drug investigation. Treasury named Ayman Joumaa, the ultimate target of that investigation, a Specially Designated Trafficker in February 2011, so presumably the investigation was very active in November 2010, when FISC issued the order. The case’s domestic component involves the car broker businesses of a slew of (probably completely innocent) Lebanese-Americans, who did business with the larger network via wire transfers.

The Car Buyers also received wire transfers for the purpose of buying and shipping used cars from other account holders at the Lebanese Banks (“Additional Transferors”), including the OFAC-designated Phenicia Shipping (Offshore); Ali Salhab and Yasmin Shipping & Trading; Fadi Star and its owners, Mohammad Hammoud and Fadi Hammoudi Fakih for General Trade, Khodor Fakih, and Ali Fakih; and Youssef Nehme.

Perhaps most interesting, the government got at these businessmen by suing them, rather than charging them, which raised significant Fifth Amendment Issues. So between that tactic and Joumaa’s rather celebrated status, I believe this is a possible case. And the timing — from 2007 until 2011, when Joumaa got listed — would certainly make sense.

All that said, this aspect of the investigation was made public in the suit naming the car brokers, so FBI would be hard-pressed to claim that providing more details would compromise the investigation.

HSBC’s Material Support for Terrorism

Then there’s a very enticing possibility: that this is an investigation into HSBC for its material support for terrorism, in the form of providing cash dollars to the al Rajhi bank which went on to support terrorist attacks (including 9/11).

HSBC’s wrist slap for money laundering is one of the most noted legal atrocities in recent memory, but most people focus on the bank’s role laundering money for drug cartels. Yet as I’ve always emphasized, HSBC also played a key role in providing money to al Qaeda-related terrorists.

As the Permanent Subcommittee on Investigations’ report made clear, HSBC’s material support for terror continued until 2010.

After the 9-11 terrorist attack in 2001, evidence began to emerge that Al Rajhi Bank and some of its owners had links to financing organizations associated with terrorism, including evidence that the bank’s key founder was an early financial benefactor of al Qaeda. In 2005, HSBC announced internally that its affiliates should sever ties with Al Rajhi Bank, but then reversed itself four months later, leaving the decision up to each affiliate. HSBC Middle East, among other HSBC affiliates, continued to do business with the bank.

Due to terrorist financing concerns, HBUS closed the correspondent banking and banknotes accounts it had provided to Al Rajhi Bank. For nearly two years, HBUS Compliance personnel resisted pressure from HSBC personnel in the Middle East and United States to resume business ties with Al Rajhi Bank. In December 2006, however, after Al Rajhi Bank threatened to pull all of its business from HSBC unless it regained access to HBUS’ U.S. banknotes program, HBUS agreed to resume supplying Al Rajhi Bank with shipments of U.S. dollars. Despite ongoing troubling information, HBUS provided nearly $1 billion in U.S. dollars to Al Rajhi Bank until 2010, when HSBC decided, on a global basis, to exit the U.S. banknotes business. HBUS also supplied U.S. dollars to two other banks, Islami Bank Bangladesh Ltd. and Social Islami Bank, despite evidence of links to terrorist financing. Each of these specific cases shows how a global bank can pressure its U.S. affiliate to provide banks in countries at high risk of terrorist financing with access to U.S. dollars and the U.S. financial system. [my emphasis]

Now, the timing may match up here, and I’d really love for a bankster to be busted for supporting terrorism. Plus, an ongoing investigation into this part of HSBC’s crimes might explain why Lanny Breuer said nothing about it when he announced the settlement with HSBC. But I doubt this is the investigation. That’s because former Treasury Undersecretary for Terrorism and Financial Intelligence Stuart Levey moved to HSBC after this point in time, in large part in a thus-far futile attempt to try to clean up the bank. And I can’t imagine a lawyer could ethically take on this role while (presumably) knowing about such seizures. Moreover, as the PSI report made clear, there are abundant other ways to get at the kind of data at issue in the HSBC investigation without Section 215 orders.

Who am I kidding? This DOJ won’t ever really investigate a bank!

WikiLeaks the Aider of Al Qaeda

I realize these three possibilities do not exhaust the list of sufficiently significant and sufficiently old terrorism investigations that might be the target named in the order. So I’m happy to hear other possibilities.

But there is one other investigation that is a near perfect fit for almost all the description provided by Hudson: WikiLeaks.

As I’ve reported, EPIC sued to enforce a FOIA for records the FBI has on investigations into WikiLeaks supporters. The FOIA asked for and FBI did not deny having, among other things, financial records.

All records of any agency communications with financial services companies including, but not limited to Visa, MasterCard, and PayPal, regarding lists of individuals who have demonstrated, through monetary donations or other means, support or interest in WikiLeaks.

In addition to withholding information that they apparently have because of an ongoing investigation (though the Judge has required the government to confirm it is still ongoing by April 25), the government also claimed exemption under a statute that they bizarrely refused to name. I speculated four months before Edward Snowden’s leaks that that statute was Section 215.

And the timing on this investigation is a perfect fit. On November 3, 2010, Joint Terrorism Task Force Officer Darin Louck seized David House’s computer as he came across the border from Mexico. While House refused to give the government his encryption passwords, the seizure makes it clear FBI was targeting WikiLeaks supporters. Then, according Alexa O’Brien, on November 21, 2010, a report on the upcoming Cablegate release was included in President Obama’s Daily Brief. The government spent the weeks leading up to the first releases in Cablegate on November 28, 2010 scrambling to understand what might be in them. On December 4, PayPal started refusing donations to WikiLeaks. And on December 6, Eric Holder stated publicly he had authorized extraordinary investigative measures “just last week.”

Nor would he say whether the actions involved search warrants, requests under the Foreign Intelligence Surveillance Act, which authorizes wiretaps or other means, describing them only as “significant.”

“I authorized just last week a number of things to be done so that we can, hopefully, get to the bottom of this and hold people accountable as they should be,” he said.

December 6 was a Monday and technically Tuesday, November 23 would have been 2 weeks earlier, just 2 days before Thanksgiving. But a Section 215 order doesn’t require AG approval, and indeed, dragnet orders often generate leads for more intrusive kinds of surveillance.

Moreover, according to Hudson’s declaration, this order did precisely what EPIC’s FOIA seems to confirm FBI did, investigate not just Julian Assange, but also his associates (also known as supporters), including WikiLeaks donors.

The only thing — and it is a significant thing — that would suggest this guess is wrong is Hudson’s description of this as a “counterterrorism” investigation and not a “counterespionage” investigation (which is how Holder was discussing it in December 2010).

But that doesn’t necessarily rule WikiLeaks out. As noted above, already by early November 2010, the FBI had JTTF agents involved in the investigation. And central to the government’s failed claim that Chelsea Manning had aided the enemy was that she had made the Afghan war logs available knowing (from the DIA report she accessed) that the government worried about al Qaeda accessing such things, and that some Afghan war logs were found at Osama bin Laden’s compound. So the government clearly has treated its WikiLeaks investigation as a counterterrorism investigation.

Moreover, all Hudson’s declaration claims is that the government currently considers this a counterterrorism investigation. Section 215 can be used for counterintelligence investigations (as I’ve noted over and over). Since the Osama bin Laden raid revealed al Qaeda had accessed cables, the government has maintained that it does involve al Qaeda. So it may be that Hudson’s reference to the investigation as a counterterrorism investigation only refers to its current status, and not the status used to obtain the order in 2010.

That said, Hudson also provided a classified version of her statement to Judge Yvonne Gonzales Rogers, and I can’t imagine she’d try to pitch the WikiLeaks case as a counterterrorism one if a judge actually got to check her work. But you never know!

It’s likely that I’m forgetting a very obviously publicly known counterterrorism investigation.

But I think it possible that either the Scary Car Broker plot or WikiLeaks is the target named in the order.