Jamie Dimon: Inspiring Fear Among “Wealthy Private Clients” Even in Disgrace

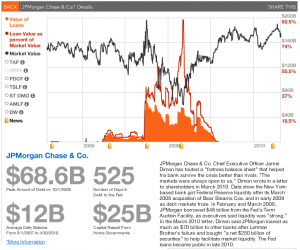

I’ve got that wonderfully satisfied yet mildly sick feeling I used to get after eating too many sweets as a kid, what with all the schadenfreude directed at Jamie Dimon and his $2 billion loss.

But I’m particularly struck by this story, in which Gretchen Morgenson recounts how Jamie DImon called Paul Volcker and Richard Fisher “infantile” at a party a month ago, for warning about Too Big To Fail banks. That piece of news, like all the rest, added to my sugar buzz. But I was struck by this passage, describing Morgenson’s sources.

The party, sponsored by JPMorgan for a group of its wealthy private clients, took place at the sumptuous Mansion on Turtle Creek hotel. Mr. Dimon was on hand to thank the guests for their patronage and their trust.

During the party, Mr. Dimon took questions from the crowd, according to an attendee who spoke on condition of anonymity for fear of alienating the bank. One guest asked about the problem of too-big-to-fail banks and the arguments made by Mr. Volcker and Mr. Fisher.

Mr. Dimon responded that he had just two words to describe them: “infantile” and “nonfactual.” He went on to lambaste Mr. Fisher further, according to the attendee. Some in the room were taken aback by the comments.

That is, Morgenson’s source(s) is not some entry level trader. He or she is a private client, a very rich person, whom Dimon was brought in to suck up to. Not just suck up to, but “thank … for their trust.”

Here we are a month later and Dimon and JPM generally have proven that trust was misplaced. If it were me, I’d be pulling my money out of JPM before Dimon pulls an MF Global with it. Yet even still, this very rich person is afraid of “alienating the bank.”

Not that that’s surprising. After all, Goldman Sachs still commands the kind of fear that leads people to invest with it, even after it became clear it was suckering clients to buy shitpile that it could then short.

Still, if there’s a sign of just how perverse our finance system is right now, it’s that the rich people Dimon is supposed to be sucking up to actually fear him, even after he has been disgraced.