“Cozy Ties Between Regulators, Politicians and Utilities” Gives New Nuke Agency in Japan, Business as Usual on Wall Street

Reuters reports this morning that Japan’s lower house of parliament has passed a law authorizing creation of a new nuclear regulatory agency. The second paragraph of the story stands out to me:

The 2011 Fukushima disaster cast a harsh spotlight on the cozy ties between regulators, politicians and utilities – known as Japan’s “nuclear village” – that experts say were a major factor in the failure to avert the crisis triggered when a huge earthquake and tsunami devastated the plant, causing meltdowns.

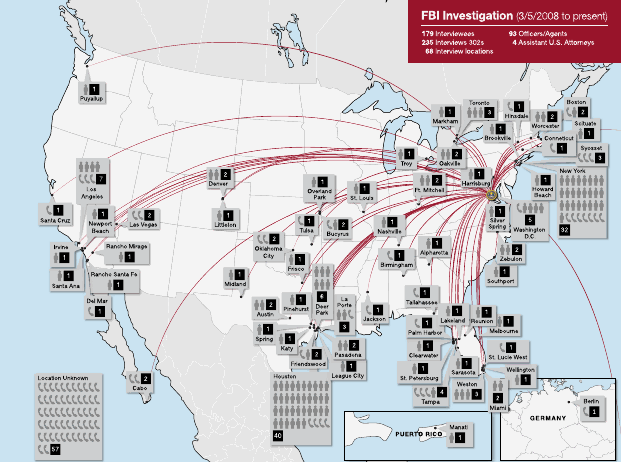

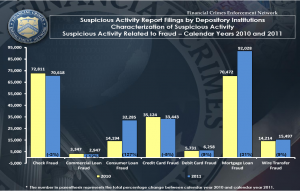

The underlying cause of the “nuclear village” where regulators are captured by the industry they regulate and the politicians also are owned by the same system applies equally as well to the situation that enabled the meltdown of global financial markets in 2008. There is far less recognition of the village aspect of Wall Street’s lack of regulation in the financial crisis, and where there have been moves ostensibly toward regulation or even prosecution of crimes, they have been a sham:

On March 9 — 45 days after the speech and 30 days after the announcement — we met with Schneiderman in New York City and asked him for an update. He had just returned from Washington, where he had been personally looking for office space. As of that date, he had no office, no phones, no staff and no executive director. None of the 55 staff members promised by Holder had materialized. On April 2, we bumped into Schneiderman on a train leaving Washington for New York and learned that the situation was the same.

Tuesday, calls to the Justice Department’s switchboard requesting to be connected with the working group produced the answer, “I really don’t know where to send you.” After being transferred to the attorney general’s office and asking for a phone number for the working group, the answer was, “I’m not aware of one.”

The promises of the President have led to little or no concrete action.

In fact, the new Residential Mortgage-Backed Securities Working Group was the sixth such entity formed since the start of the financial crisis in 2009. The grand total of staff working for all of the previous five groups was one, according to a surprised Schneiderman. In Washington, where staffs grow like cherry blossoms, this is a remarkable occurrence.

We are led to conclude that Donovan was right. The settlement and working group — taken together — were a coup: a public relations coup for the White House and the banks. The media hailed the resolution for a few days and then turned their attention to other topics and controversies.

But for 12 million American homeowners, collectively $700 billion under water, this was just another in a long series of sham transactions.

Perhaps in homage to the Schneiderman and other sham units, the Reuters article on Japan’s new agency does show a bit of caution regarding the new agency:

The legislation, however, swiftly came under fire for appearing to weaken the government’s commitment to decommissioning reactors after 40 years in operation, even as it drafts an energy program to reduce nuclear power’s role.

Under a deal ending months of bickering by ruling and opposition parties, the new regulatory commission could revise a rule limiting the life of reactors to 40 years in principle.

“Does this reflect the sentiment of the citizens, who are seeking an exit from nuclear power?” queried an editorial in the Tokyo Shimbun daily. “Won’t it instead make what was supposed to be a rare exception par for the course?”

And as for the coziness between politicians in the US and the financial industry, we need look no further than Wednesday’s appearance by Jamie Dimon before the Senate Banking, Housing and Urban Affairs Committee. One of Marcy’s tweets during the hearing says all we need to know about that “hearing”:

BOB CORKER WIPE THAT SPOOGE FROM YOUR CHIN RIGHT NOW!

Japan’s response to its meltdown has been to shut down all nuclear plants while the framework for how they will operate if they are allowed to restart is debated. Imagine how much better off the world would be if JP Morgan Chase and Goldman Sachs had been shut down while a proper regulatory framework for them was developed.