Empirical Test of Piketty’s r > g Theory Coming

Bernie Sanders forced the issue of wealth inequality into the presidential campaign, which presented a real problem for neoliberals of the Democratic persuasion. They want us to believe that the market rewards people in accordance with their merit and hard work. It doesn’t. They want us to believe everyone can get ahead if they get a good education and work hard. Not so. So the neoliberal dems fall back on their version of trickle-down: economic growth is the cure. So what is the future of economic growth?

Earlier this year Gerald Friedman did a study of the potential impact of Bernie Sanders’ economic ideas, saying they would create enormous economic growth. That drew fire from many liberal economists, including Paul Krugman who wrote several blog posts saying Friedman’s numbers were ridiculous, and using that as a opportunity to bash Sanders supporters for naiveté and for encouraging impossible expectation. On February 23, he put up a post with his own predictions of growth: a fraction over 2%. And that, he says, is good enough.

And let me say that the great thing about a progressive agenda is that it doesn’t require big growth promises to make it work, because the elements of that agenda are good things in their own right. Conservatives need to promise miracles to justify policies whose direct effect is to comfort the comfortable (cutting taxes on the rich) and afflict the afflicted (slashing social insurance); progressives only need to defend themselves against the charge that doing good will somehow kill economic growth. It won’t, and that should be enough.

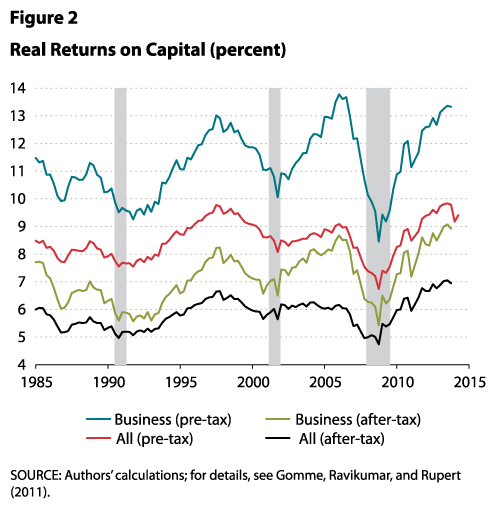

But what about inequality in this scenario? Thanks to Thomas Piketty and his book Capital in The Twenty-First Century, we can say with some certainty that it isn’t going to get better with this kind of thinking. Remember Piketty’s basic finding: if r > g, wealth inequality will increase to a very high level. In this formulation, r is the rate of return to capital, and g is the growth rate of the economy. Here’s a chart from the St. Louis Fed showing the rate of return to capital in the US:

With the exception of the immediate post-Great Crash years, the All capital after tax line doesn’t sink below 5%, and the most recent figures show it near 7%. Here’s the definition, found in Note 5:

“Business” capital includes nonresidential fixed capital (structures, equipment, and intellectual property) and inventories. “All” capital includes business capital and residential capital.”

Piketty’s definition of capital is broader than this definition of “all”, but there isn’t any reason to think that will have a material effect on the overall number. In other words, r is about 5% higher than g, so we can expect a steady increase in wealth inequality.

The Republicans couldn’t care less: they nominated a billionaire. What’s on offer from the Democratic Party? Here’s Hillary Clinton’s webpage on economic issues. It’s mostly neoliberal ideas, from cutting taxes to deregulation to trade (see the part on small businesses), and some liberal ideas: investment in infrastructure and research, equal pay, paid leave and affordable child care. Her new idea? Let’s give tax breaks to companies that share profits with workers. Also, raise the minimum wage to $12 some day, and some tiny steps to increasing taxes on the rich by closing loopholes and making sure rich people pay more taxes than Warren Buffett’s secretary.

We are going to get an empirical test of Piketty’s idea, but we already know how it will turn out. The rich have nothing to fear.

quote”We are going to get an empirical test of Piketty’s idea, but we already know how it will turn out. The rich have nothing to fear.”unquote

yet…. give it a few years. Once the streets are running with their blood… we’ll see. Of course…those are Piketty’s words..so to speak. There are 300 million gun owners in the US. Most of which are made up of the poor. You give them a reason to revolt.. and they will. And it won’t be pretty. So far..they haven’t had one. But let me put it this way. Should the .1% poke a sleeping Badger with a sharp stick.. he’ll rip their fucking balls off. And then eat them.

I was going to make, less eloquently, a similar point. Then I remembered that, underlying socialism is not envy or anger but love.

The lives of the hyper rich are, for the most part, empty and vulgar, devoted largely to working out new ways to fit more into their various bellies, all the while wondering whether there is a God, and, if there is, how he could possibly not want to punish them for the lives they have led. And the lives that obsessively seeking advantage ruins.

And it strikes me that, given that socialism will ensure that there is sufficient for all, forever, and that there is no rational justification for hoarding for inheritances or over feeding against the inevitable dearth, no class will benefit more from being freed from the grip of capital accumulation and fear of falling behind, than the rich.

In other words they have nothing to fear, and like the world’s workers, nothing to lose but their, albeit largely mental, chains.

Meanwhile…

https://3.bp.blogspot.com/-Ld-dlZYajkg/VytYfIeXalI/AAAAAAAAhN4/TuJC3J0oxfcg5qBnmPtCcnh34ST5mz4IwCLcB/s320/12-trillion.jpeg

.

That is easily answered:

.

https://en.wikipedia.org/wiki/Prosperity_theology

.

There may not be 300 million owners but there are at least 300 million guns. That’s why they need to somehow get them taken out of circulation.(good luck there) I haven’t seen this much unrest since the late 60’s. The fact that two unlikely wildly disparate candidates would garner so much attention shows the amount of unrest with average citizens. One on the right has secured the top spot. The so called left is rigged to keep the power in place.(we can’t actually have real change now can we?) Things are soon going to get interesting. Will people get a chance to speak out before the planet erupts in flames due to global warming? I’ll keep watching…

1.

Consumer interest is the penalty that the borrower pays for being poor –

or, more specifically, for being poorer than the lender.

.

Without government intervention, the poorer a person is, the larger

the penalty (relative to income) that the person must pay just to survive.

Welfare and other government benefits should be designed so that no

one has to borrow money (i.e. pay this penalty) to stay alive. There

should be a “fixed basket” of minimal goods and services that everyone

is entitled to without having to borrow money and pay the rich their

interest. Food, necessary medical care, other goods and services

deemed by policy makers to be “necessities” should be easily within

the budget of every 40 hr/week income, or else subsidized by the

government.

.

Another way to put this is that the government should have resources

and a mechanism to prevent the coercion of the interest-penalty from

the poor to the rich.

.

For the middle class with sufficient income to put food on the table and

pay medical costs and other necessities, interest is the penalty paid to

obtain immediate gratification of a standard of living higher than the

payer’s income alone can provide at the moment – ownership of real

property, vehicles, travel, entertainment, and tons of bling and crap

that end up in the dump. But it’s still a penalty for not being rich enough

not to need to borrow, or a penalty for not having enough self-restraint

to put off unnecessary purchases until enough disposable cash is

available; or a greed-tax.

.

There are three types of services no one should ever be deprived of

or have to pay interest to acquire: 1) necessary medical care; 2) necessary

legal services; 3) all the education they are capable of and willing to

absorb. All of these should be nationalized to level the Darwinian field

and then let the greedy bastards fight a fair fight to keep what they can.

.

2.

If r > g means there is transfer of wealth upward, does Piketty claim

that r < g means there is a wealth transfer downward? Can the Fed control

the rate and direction of the flow of wealth merely by adjusting interest

rates? Good, problem solved. Even Trump could figure that out (gross hyperbole).

As to your second point, no, that is not what it means. The rich can take all the money regardless of the relative rates. The difference is that in the case of r > g, the government can use taxes and other means to reduce the return to capital. In our country there is plenty of capital, and more in the rest of the world, much of it stolen and hidden offshore. Piketty suggest a number of steps to deal with that accumulation. It isn’t as hard as it looks. You could, for example, impose heavy taxes at the business level as well sa at the corporate level on compensation in excess of a certain amount and couple that with large taxes on income in excess of certain amounts. You could end favorable treatment of capital gains. You could extend and increase estate taxes. You could have heavy-handed tax enforcement of incomes above a certain amount. You could insist on transparency in business entities and tax imformation sharing among nations and other levels of government. And so on. These same ideas can generally make sure the filthy rich don’t take all the money regardless of r and g.