The White House Crypto Czar: Trump’s Election Has Helped Bitcoin Far More than the Dollar

As the dollar surged immediately after Trump’s election win, reports attributed it to Trump’s expected business-friendly climate (as if chaos helps businesses thrive), perhaps even to Trump’s populist bluster about tariffs targeting competing state currencies.

More recently and dramatically, Bitcoin has surged as Trump has named one after another crypto enthusiast to key posts, most notably Paul Atkins to SEC Chair.

Donald Trump’s win has accompanied a 3.5% boost in the dollar. His win has contributed to a 53% surge in Bitcoin.

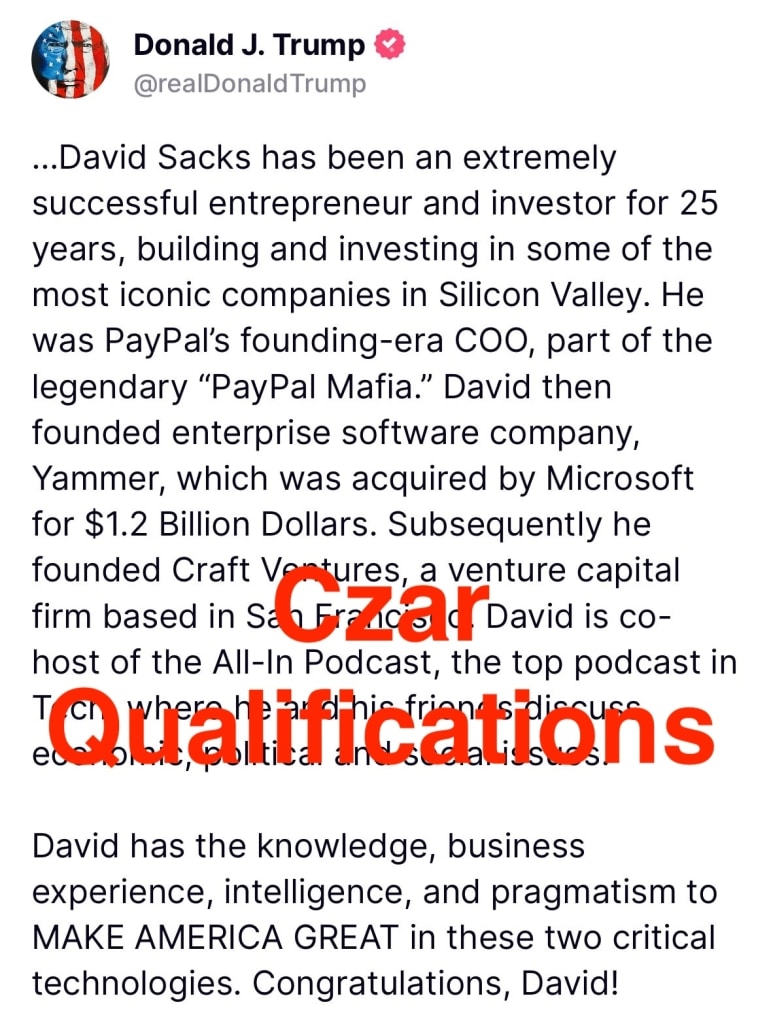

And all that was before his announcement that David Sacks would be his White House crypto and AI “czar,” as well as the head of Trump’s Council of Advisors for Science and Technology.

The press coverage of the pick is a tiny bit more skeptical than Trump’s own announcement. Trump emphasized the success of Sacks’ All-In podcast.

In addition to his fundraising for Trump, news outlets noted that Sacks refused to take any position that would require him to step down from his own VC fund and will be hired under a designation that does not subject him to public financial disclosure rules. A few even mentioned his long ties to Peter Thiel.

But they left out two other important details.

First, Sacks is an unusually enthusiastic and unashamedly stupid Russophile. He parrots Putin’s propaganda even more dumbly than Tucker Carlson.

Second, Sacks played a huge role in contributing to a run on Silicon Valley Bank and then wailing for a bailout. He has a very recent history of privatizing the risk his reckless policies presents.

These twin developments — the rise of the dollar and the far more dramatic surge of Bitcoin — stem from two parallel Trump instincts. His defense of the dollar as reserve currency stems from his genuinely held but incompetently implemented belief in America’s Greatness™.

But his enthusiastic embrace of cryptocurrency arises from his corruption.

The self-dealing behind Trump’s World Liberty Financial was clear from the start. It was made more obvious when Justin Sun bought $30 million in World Liberty crypto tokens last month, effectively handing the newly elected President $18 million.

On November 25, Sun purchased $30 million in crypto tokens from World Liberty Financial, a new crypto venture backed by President-elect Donald Trump. Sun said his company, TRON, was committed to “making America great again.”

World Liberty Financial planned to sell $300 million worth of crypto tokens, known as WLF, which would value the new company at $1.5 billion. But, before Sun’s $30 million purchase, it appeared to be a bust, with only $22 million in tokens sold. Sun now owns more than 55% of purchased tokens.Sun’s decision to buy $30 million in WLF tokens has direct and immediate financial benefits for Trump. A filing by the company in October revealed that “$30 million of initial net protocol revenues” will be “held in a reserve… to cover operating expenses, indemnities, and obligations.” After the reserve is met, a company owned by Donald Trump, DT Marks DEFI LLC, will receive “75% of the net protocol revenues.”So before Sun’s purchase, Trump was entitled to nothing because the reserve had not been met. But Sun’s purchase covered the entire reserve, so now Trump is entitled to 75% of the revenues from all other tokens purchased. As of December 1, there have been $24 million WLF tokens sold, netting Trump $18 million.

All this has the potential to go horribly wrong.

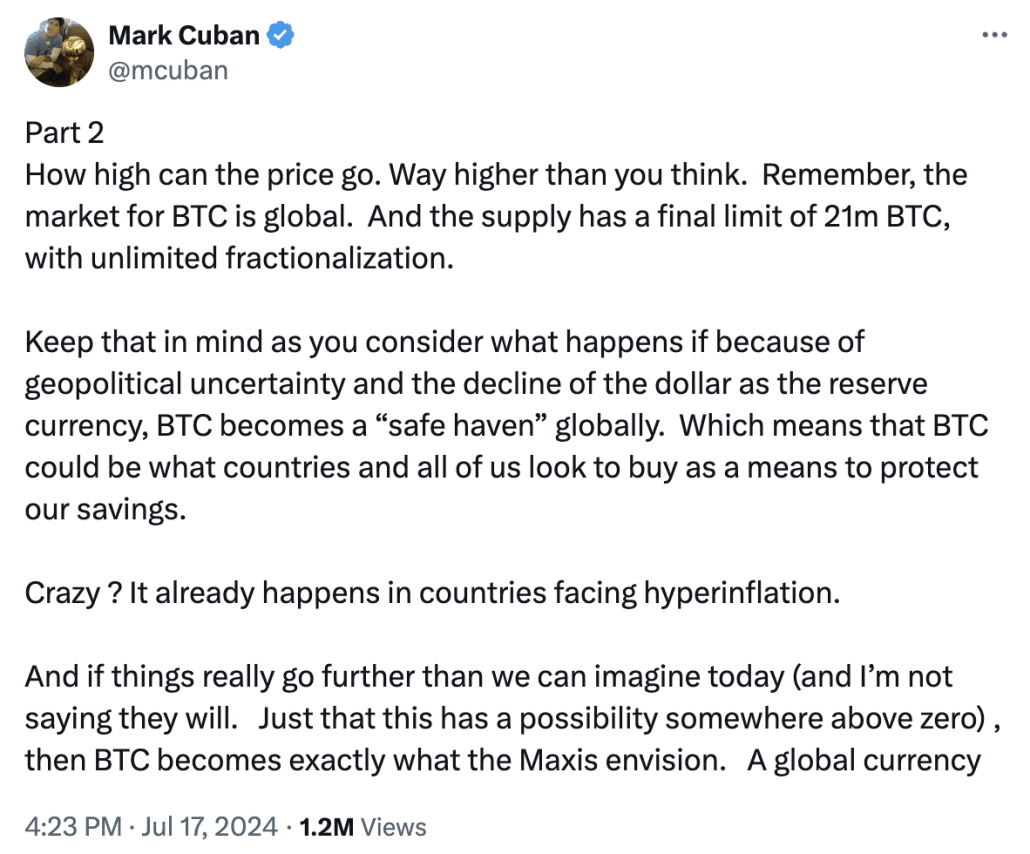

And predictably so. Back in July — after Sacks had brokered the marriage between Musk and Trump but long before Trump rolled out his own crypto scam — Mark Cuban had this to say about the alliance.

And while I don’t ascribe to everything in this more ambitious prediction from Dave Troy from 2022, some have been predicting this confluence of events even longer.

One thrust of Trump’s transition plans — those stemming from his kneejerk parochialism — have focused on making The Dollar Great.

A just as significant thrust — granting reckless support for bubble cryptocurrency — arises from his venality.

With Trump, it’s generally safe to bet his greed will win out over care for anyone but himself.

Update: Added the caveat “public” before financial disclosure. See Kathleen Clark’s thread for an explanation.

The Guardian had a story on Russian moneylaundering via cryptocurrency two days ago that I haven’t seen picked up by the US media, that seems more than a little connected to the increasing embrace of crytpocurrencies by the incoming administration:

Now, the Treasury Dept put out their own related press release, even if the NYT, WaPo, and others seem more interested in watching the cryptobros headed into office:

Yup. Originally this was going to be a post about my insomnia from two nights ago thinking about how Putin has focused on pushing crypto for that very reason.

That one (and more insomnia) will come. The Treasury sanctions are important. And so long as Labour can remain in office in the UK, they seem intent on picking up that role, assuming Trump will abandon it.

My first thought was that the US and UK investigators moved to roll these folks up now, because waiting until next year might derail the whole thing with the arrival of the Trump administration.

Our son got suckered into the FTX scam and lost tons. It’s all a scam. Luckily he learned his lesson

at the bar in my London hotel in June, when the immigrant bartender heard I was American, he got all excited: “Donald Trump!! Yeah man, he is going to do great things for my crypto!”. it was my first moment of: uh oh.

Or . . .

Maybe the bartender was just trying to boost his sales, by encouraging you to drink heavily.

didn’t work! i downed my drink and got the hell out of there. now election night eve one month ago i retreated to my neighborhood bar to avoid election results. as i was leaving, the man seated next to me, looking in his phone, said “you might want to order another…”. it was my first moment of: oh fuck.

I felt the same way, rosalind, when my air conditioning repair man said something similar.

England is mad for gambling. Totally mad. The rest of the English speaking world not far behind. It is ominous.

Tulip mania, all over again. No real underlying value except for the sentiments of speculators.

What did it take to collapse the price of tulips? The unwillingness of anyone to bid and buy because the price was excessive. The market collapsed almost overnight. We’ve already seen this happen with another digital token, NFTs, and those were linked to crypto currency at one point in order to prop them up but without success.

I pity those whose faces will be eaten by the speculation they foolishly indulged in.

Well said!

My friends in the Netherlands would agree with you!

Reply to Sussex Trafalgar

December 6, 2024 at 11:14 am

You can see the same dynamic at work with meme stocks like GameStop. Even Tesla, which should have been hammered for its gross failures as an automaker but meme stock fanbois keep it propped up. So much stupid combined with just enough money to make them dangerous.

The 1990s ponzi schemes in Albania is my modern go to example. Crypto is all get rich, pump and dump schemes to fleece people.

At least tulips are pretty.

[Welcome back to emptywheel. Please use the same username, email address, AND URL each time you comment so that community members get to know you. You’ve attempted to publish 3 comments to date at this site; you’ve triggered auto-moderation with the last two because the URL supplied didn’t match the one used on your first comment. Every space, letter, and punctuation mark in username/email/URL matters and must match. Your URL has been has been edited to reflect the first one used which was https-colon-double slash-www not https-colon-double slash. Please check your browser’s cache and autofill; future comments may not publish if URL does not match. /~Rayne]

Well, tulips are pretty and you can eat them when the failing market bankrupts you, crypto doesn’t even offer those slight benefits. Tulipmania without even getting a damn tulip out of it.

Just in case Dave Troy is correct:

https://toad.social/@davetroy

https://america2.news/welcome-to-america-2-0/

Quoting:

https://docs.google.com/document/d/e/2PACX-1vQZj9-tPe4uvyqobUYd1BUs7xjeDSWUH-TGgy8VHFQwrLK8zZIGcYBf_dhWUhZ69pe-jgO6FNimCOra/pub

“MANAGING FINANCIAL INSTABILITY IN 2025

The incoming Trump/Vance administration has the potential to unleash widespread economic harms, many of which are not on people’s radar. This document is not financial advice and I am not a financial advisor. I am an analyst of history and warfare, and this is an analysis of current warfare operations.

“4. Bitcoin is a weapon.[6] Bitcoin sets up a zero-sum game between holders and non-holders, enhancing holders’ purchasing power while eroding the dollar and the purchasing power of non-holders. People who do not hold Bitcoin (or derivatives) will be impoverished at the expense of people who do. It is impossible to hedge by buying Bitcoin without eroding the value of dollar holdings. Importantly, Bitcoin is a Ponzi scheme that harms non-participants — i.e. it’s not enough to avoid it, and you can’t just ignore it.[7] It must be destroyed, as 19th century Wildcat Banking was taxed out of existence. Republicans are now promoting Bitcoin, and the creation of a “U.S. Strategic Bitcoin Reserve,” which is intended to set off a vicious cycle that will spike the price of Bitcoin while undermining the dollar. This will prove ruinous.

“POTENTIAL MITIGATORY AND DEFENSIVE MEASURES

“2. Do not hedge with Bitcoin or crypto assets. While this might be tempting, it is important to understand that Bitcoin and “real economy” assets are opposed in a zero-sum game. Every asset in Bitcoin harms all your other assets, while helping speculators.”

“JANUARY 2025 TIMELINE

The most dangerous period will be the first six months of 2025, which is when the budget and debt ceiling issues must be addressed. The government runs out of money on January 2. The new Congress will be installed January 3. If no budget or debt ceiling bill is passed by January 2, Secretary Yellen will need to invoke “extraordinary measures” to limit cash expenditures through January 20. Then, a new acting Treasury secretary (probably an extremist aligned with the crash plan) may be installed as soon as January 21. They would then need to oversee Treasury expenditures until the “X-Date” (the actual date of US default, likely in Spring 2025) and give Congress accurate information about status and risks. In the event that no resolution is reached, default will likely occur around May 2025, triggering a global asset meltdown.”

“ADDITIONAL FREQUENTLY ASKED QUESTIONS

Q: How will this get resolved?

A: When mainstream Republicans realize their party has been captured by a hostile foreign power, that their financial security is at grave risk, and they take action to deal with that fact. Help them understand that’s what’s happened.”

Although the amount of money in the world has been on a rocket ship ride for 40 years there isn’t enough of it. Billionaires need trillions. Money is extremely popular. Everyone wants more. All money, everywhere, even and especially China is created by bank loans. Loans create bank deposits and bank deposits are money. No intermediate steps. Loan=money. The obverse is also true. Loan payment=money disappears. Central banks create money when they buy securities like Treasury Notes, which are not loans per-say they are loans once removed but the result is the same. A bank account balance, which is money. Banks have an absolute monopoly on creating money. The government has nothing to do with it. It just prints and mints the money tokens. Understandably banks like this monopoly.

You can’t take your crypto to the bank and deposit it. So since it isn’t a bank deposit it isn’t money. Period. Full stop.

Oh, and about crypto and politics and society? It’s complicated and in flux. It is the biggest thing out there. There is no other way for Musk to send people to Mars, to die.

From crypto to crypt on SpaceX slave ships.

You’re not completely accurate about money, but you’re close enough for your basic point–that crypto is not money–to be correct.

Anyone looking for a good discussion see Berkeley professor Nicholas Weaver’s videos on the topic. Here’s one, there are others (https://www.youtube.com/watch?v=xCHab0dNnj4)

If folks are interested in an authoritative view of money and banking, Perry Mehrling has a great course available 2 ways. First, he has it posted at INET (Institute for New Economic Thinking, https://www.ineteconomics.org/education/courses/the-economics-of-money-banking). It’s also in a slightly different form at Coursera, to which your library may grant access for free.(https://www.coursera.org/learn/money-banking). It can be a bit of a slog at times, but he’s a great teacher.

You should also take a look at “The Myth of Helicopter Money”, which is a brief article running down the various steps in money creation. (https://www.project-syndicate.org/commentary/modern-monetary-theory-is-not-helicopter-money-by-yeva-nersisyan-and-l-randall-wray-2020-04). There are many other articles that discuss monetary operations at the Fed; I think this is the best (though it might assume a little more knowledge than some of the others do).

In short, the government has the sole right to create money and delegates to banks the ability to create deposits from loans (because they’re presumably better acquainted with the borrower) but deposits aren’t really the same as Federally-created dollars. And the US government never actually borrows money when it sells bonds, which the article clearly illustrates.

No, I’m right.

I am speaking of the mechanisms of money now in use, not some theoretical kind of money.

A government could “issue its own money” but no government in the world does. Treasury could print up $1TN in currency and take it to the Ecclels building and say deposit this in our account Jerry. You see the Fed has an account for the US Treasury from which it issues checks. The Fed could refuse to take the deposit as the bills would be different since they can’t say Treasury Note (A note is a claim on an account, not a source of funding an account) so one can notice the difference. Perhaps legislation would be needed to force the Fed to take them for deposit. Until then they could send the cash to SS recipients and General Dynamics etc.

The US Mint does issue gold and silver coins with various face values which are legal tender. Go here. https://www.moneymetals.com/buy/gold/coins/american-gold-eagle. Your shiny $1 coin must be accepted by the store to buy a $1 item. Or take it to the bank and deposit it, for $1. have at it. They are generally accepted to be legal tender, so are money in practice if not specifically legal.

Currency is irrelevant. Virtually all money is digitally created…

And in the case of QE the money supply was dramatically increased (unlike normal monetary operations, which keeps the money supply more or less unchanged.

Read Wray’s article – it’s not long.

Let’s be more specific: Article I, Section 8 of the U.S. Constitution says Congress has the power to

And in tandem and in relation to those powers, Congress also has the power to

which establishes how coined U.S. money will be exchanged; and Congress has the power to

which will affect the value of coined U.S. money when trading with other countries.

Anything not coined by the U.S. with Congressional approval, not regulated by the U.S. with Congressional approval, has all the value of spit outside contracts between entities, if that contract is legitimate under terms established by Congress’s power to regulate commerce.

We should be identifying which members of Congress understand this and aren’t compromised by crypto-tulip mania.

I think this is important to read just to try to make sure it doesn’t happen.

Quoting:

https://www.mind-war.com/p/grand-theft-crypto-strategic-bitcoin

Grand Theft Crypto: “Strategic Bitcoin Reserve”

Jim Stewartson

“There is a major push for a “Strategic Bitcoin Reserve” — led by Wyoming Senator Cynthia Lummis….

“The idea is that over the course of 5 years the US government would be forced to purchase 200,000 Bitcoins with actual physical gold reserves, every year. At the current price that would be $100 billion in precious metal in exchange for 1,000,000 worthless prime numbers.

“But, and this is important, the government would be forced to “hodl” (hold on for dear life) for 20 years minimum — effectively the heat death of the Universe in crypto. Bitcoin technology with {sic} be completely obsolete.

“The idea that we would trade a massive chunk of Fort Knox for completely worthless numbers which only have value in the price you can sell them for — and then give up the option to sell it — would be comedic if it didn’t have such a good chance of happening.

“On Thursday, Donald Trump invented a new White House Czar for “AI & Crypto” and designated white supremacist PayPal Mafia oligarch, David Sacks, Musk’s best buddy, for the “job.”

“Note that Howard Lutnick, friend of Jeffrey Epstein, who committed millions as co-chair of the Trump campaign, launched Rumble for Peter Thiel, and manages $100 billion of Tether, the “stablecoin” underlying Bitcoin, has been nominated to be Secretary of Commerce. They have got the economy surrounded.”

If Republicans try to manufacture a debt default, the American Monetary Institute has annual monetary conferences that advances the history (Washington, Lincoln Greenbacks & Kennedy initiated this) and theory of U.S. government issuing money as income, not as debt.

If all money is debt, you cannot pay off debt with more debt.

AMI is updating new site.

Quoting:

https://monetary.org/resources/intro-to-reform/monetary-reform-faq/

10) How will the U.S. Treasury create the money?”

The same way the Federal Reserve does now, as simple account entries, but as income, without the accompanying debt obligations. It’s described in the AMA, Sec. 103 NEGATIVE FUND BALANCES: The Secretary of the Treasury shall directly issue United States Money to account for any differences between Government appropriations authorized by Congress under law and available Government receipts.

Any nominee without a basketful of conflicts of interest and allegations of impropriety or illegal acts would not be a Trump nominee.

Game recognizes game.

Steve Jobs is famously credited with saying “A players hire A players, B players hire C players, and C players hire D players.”

So, yeah, game recognizes game.

Now, now. Billionaires have rights, too!

“Second, Sacks played a huge role in contributing to a run on Silicon Valley Bank and then wailing for a bailout. He has a very recent history of privatizing the risk his reckless policies presents.”

If I understand the implication of “wailing for a bailout,” I believe you intended “socializing the risk.” It’s a private risk but a social bailout.

[Welcome back to emptywheel. Please use the SAME USERNAME and email address each time you comment so that community members get to know you. You attempted to publish this comment as “Justice of the Peace” triggering auto-moderation; it has been edited to reflect your established username. Spaces and punctuation marks matter. Please check your browser’s cache and autofill; future comments may not publish if username does not match. /~Rayne]

Outstanding and timely piece, along with equally outstanding comments by Peterr. And the Guardian piece on Putin money laundering says it all.

The Putin/Mogilevich led organized crime syndicate is working hard now instigating the current political uprisings in South Korea and France.

They got their man Trump re-elected in the US.

Now, if they can put Marie Le Pen in power in France and bring a new and more pro Putin and Kim Jong Un government to power in South Korea, they’ll ensure several more years of their crime syndicate’s survival along with the billions it makes every year.

The “great bifurcation” and BRICS

Does Elon have a relationship with each element of BRICS?

Brazil? Yeah

Russia? Yeah

India?

China? uhhh, yeah

South Africa? Yeah

It’s not only shady Rusiian oligarch crypto outfits “operating” out of Wyoming – that’s also the headqaurters for the companies licening Trump’s image on junk such as sneakers, watches, and guitars. This all stinks to the high heavens as evinced in this piece from the ICIJ : https://www.icij.org/investigations/pandora-papers/the-gatekeepers-who-help-open-america-to-oligarchs-and-scammers/

Wyoming is just the latest state to legalize global money-laundering. I’m half-way thru Casey Michaels book, ‘American Kleptocracy’.

No identification needed for creation of LLC’s, shell companies, bank accounts and legal representation if needed. No trace of sources for shrieked-wrapped cash coming in or out. Completely legal in Nevada as well. Of course Delaware got the corporate ownership shell game going years ago.

Looking at even the near future with Musk, Trump, crypto- billionaire donors, cabinet members all on the same greedy side of a global asset trade, with a compliant house/senate/judicial. What could go wrong? The sheep will get shorn as usual.

Is Mark Cuban a currency expert? A trader? Are there contrary opinions to his, as quoted?

“All this has the potential to go horribly wrong.”

And when it does, it will be blamed on Soros.

Trump wants a weaker dollar for some of his objectives, a stronger dollar for other objectives. He does not understand any of this, so it is impossible to foretell which stupid decision he will take.

In the short run, he may well cause serious damage to someone — perhaps even everyone. In the slightly longer term, everything will be down to the bond vigilantes.

Treasury could have hedged the debt by selling 30-year (or even longer) bonds at negative real interest coupons but that train has left the station. (This will sound crazy but 120 years ago London firms were successfully selling 999-year gold bonds, and even within my working lifetime I remember Japanese three-generation mortgages. Money illusion is a powerful drug.)

‘Enormous heist’: Hayes on the ‘audacious scheme’ to reward big donors [VIDEO]

https://www.youtube.com/watch?v=qWANiC28M8o 12/6/24

Ryan Cooper at The Prospect:

The Crypto Plot Against America’s Gold Reserves National Treasure: Bitcoin Edition https://prospect.org/power/2024-11-26-crypto-plot-against-americas-gold-reserves/ Ryan Cooper November 26, 2024

More from the HAYES segment:

For more on that 7/27/24 CRYPTO Conference in Nashville

[including TRUMP being there], scroll up and down from this comment:

https://www.emptywheel.net/2024/07/23/fraudulent-failson-judgement-jd-vance-aint-from-here/#comment-1063358

Thank you for information. I had not yet seen your post, before adding same information from another source.

I ,too, think this is important to know and try to stop.