If Mitt Had Had His Way, San Diego Would Have Had to Lay Off Another Teacher So He Could Send More $$ Overseas

Had Mitt Romney gotten his way when he asked to have his La Jolla home tax assessment lowered in the wake of the financial crash, San Diego County would have lost enough money to hire a teacher, at a time when the district has been laying off teachers and deferring raises.

Had Mitt Romney gotten his way when he asked to have his La Jolla home tax assessment lowered in the wake of the financial crash, San Diego County would have lost enough money to hire a teacher, at a time when the district has been laying off teachers and deferring raises.

At least that’s my rough calculation based on the numbers included in this LAT article describing Mitt’s efforts to have his home reassessed the year after he purchased it in 2008.

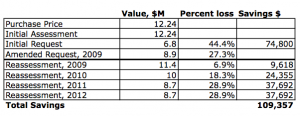

As the LAT describes it, Mitt submitted one proposed reassessment, claiming their home on the beach in La Jolla had lost almost 45% of its value. After that didn’t work, they got a lawyer to submit a new appeal; he came up with a more modest claim that the house had lost 27% of its value in the first year, or 39% over two years. San Diego County responded by assessing the home had lost 7% of its value. And only after two more years of declining home prices did the county agree with Mitt’s lawyers amended appeal of a 27-29% loss.

All told, $250 million Mitt has saved $109,357 on his property taxes.

But I want to look at Mitt’s original claim–that his house had lost almost 45% of its value in less than a year. That claim was higher even than the property decline all the houses in his zip code experienced in the two years after he bought the house.

Working for the Romneys, Streb concluded that the entire 92037 ZIP Code had suffered a 41% decline in average sales prices between the first six months of 2008 and the six months preceding his appraisal in October 2010. He settled on a value of $7.5 million for the Romney home.

Had Mitt’s outrageous claim been successful, he would have saved something like $75,000 a year. This amounts to Mitt, buying a pricey home at a time when any half-witted being knew home values were crashing, turning around almost immediately and asking for a discount for buying at a time of falling values. But for a county struggling with the effects of banksters ruining the wealth of its much more average residents, it amounts to a real churlishness about the common good.

The LAT ends by justifying Mitt’s efforts to save what amount to a few pennies on property taxes.

“I would think it’s foolish not to request a decline in value if you are entitled,” said Paul Habibi, who teaches real estate finance and development in the UCLA Anderson Graduate School of Management. “That’s like saying a rich man should not bend over to pick up a hundred dollar bill.”

Or you could look it another way. Most rich men, standing over a hundred dollar bill next to a poor kid, would let the kid take the bill. Not Mitt. He’s gonna hire a lawyer to elbow the kid away from the cash so he can pocket it himself.

But wait, there’s more!!

Dragon may be on to something, if Mitt’s the POTUS he has head-of-state immunity and can go on the Tuscan vacation he always wanted.

In the grand scheme of things, however, one cannot fault Mitt for trying this, even if the price was so ridiculously low that even San Diego couldn’t let it go. After all, this is where Darrel Issa and Bill Billbray come from.

One also wonders whether Mitt claimed the homeowner’s exemption which applies to the primary residence here in CA.

As a kid I stayed a few miles south of exclusive, pristine beached La Jolla, in a less expensive area called Mission Beach. La Jolla had exclusive knolls, arcing sea views. Mission was alright, beach slightly less clear, and feeling less exclusive. The grunion were about to run, little fish people could find on the beach at night; but we left before the Mission run. We left before the era of any possibility of A good day for bananafish either, though teenage was approaching, as were the early twenties in my life. The way I remember, bananafish are a last resort, a sort of hobbling fish which inhabits murky water.

But the Mission Beach ocean perch were splendid as was the surf.

San Diego city council districts map there.

California’s real estate taxing system is badly broken. Even Warren Buffett agrees on that. One thing that makes that a national disgrace instead of a state-level boondoggle is that it is home to many of America’s most expensive residential properties, owned by the wealthiest of people and the companies, partnerships and trusts they employ to shield themselves from publicity and liability.

The brokenness is one more subsidy for the aching millionaires. They would no more leave their coastal or desert-view properties because of modestly higher taxes on them than they would gladly move to Gary, Indiana or Youngstown, Ohio.

Mr. Romney’s gamesmanship over property taxes is routine, routinely ballsy and routinely predatory. True, some Californian home values have taken a dive, but not many of them are luxury properties within eyeball distance of the deep blue sea. The idea of a premier La Jolla or Del Mar property declining in value in a short space of time by 45%, absent a tremor that moved the oceanfront eastward about 3/4 of a mile, is laughable.

@JohnLopresti: It’s still pretty nice, better north of the river’s outlet. I agree, Ocean Beach, Dog Beach, Pacific Beach and Mission Beach are for hardcore surfers and tourists (and townies’ pets), compared to pristine, North Cornwall-like Wind and Sea. The morning coffee and muesli in Ocean Beach is still the best.

@earlofhuntingdon: yeah, though it’s not just CA. My cousin is solidly middle class in Reston, VA. It’s pretty well known that all the rich assholes–starting with Dick Cheney–who live there have gotten their houses WAY underassessed.

@emptywheel: #7

What makes CA different is that the assessed value starts at the baseline [typically the sale price] which can then only go up about 1-2 % per year, regardless of the market. In a bubble, that means two identical houses next door to each other would potentially have radically different tax bills. In addition, since developer corporations would not necessarily get rid of land [even if the tenants change over time] they would be paying the assessed value from 1976 adjusted by the minimal percentages over the years, which is another hidden tax break for the landlords as well as a severe hit on the local cities and counties because the corporate property taxes are held well below market. Where VA assessors may cut ad hoc sweet deals, it’s the law in CA.

Proposition 13 also made the 2/3 majority requirement that the GOP uses every year to hold the state hostage at budget time. MI needs to torpedo that idea, it doesn’t work in CA nor in CO where TABOR rules.

BTW CA in the last election cut back the supermajority necessary, and it’s no coincidence that the budget has been on time since.

re: E of H @6. We ‘slummed’ in Ocean Beach, too. The world seems differently peaceful out there.

re: my @4,3. The SD city council district perimeters clearly appear to be sensitive to the exclusivity up La Jolla way.

And my mysterious link about Bananafish is to a JDSalinger tale, though he called the day ‘perfect’.

CA property tax law is an interesting realm.

Historical aside, CA also recently ended the existence of redevelopment districts, one workaround to find tax money while tax rolls languish in the ambience of the 1970s tax revolt in the state.

Property ownership also is a classical counterbalance against the shifts of economic times; especially substantial amounts of property.

@emptywheel: “Reston, VA” Way OT, sorry. Long ago we used to like to ride out to Reston to drag race. There were nice straight flat roads in undeveloped areas that were high enough you could see the cops coming a long way off. That and the whiskey made there put a different spin on “planned community”.

@rugger9:

Well, we also voted to dock the pay of the legislature (and the governor and other elected officials) for the entire period the budget is late. Hit them in their wallets, if all they value is money.

@emptywheel: Yup, Northern Virginia is reputedly the wealthiest few square miles of America, including the Left Coast. No surprise that it’s inhabited by inherited wealth, and defense and intel contractors. Come to think of it, that’s probably now redundant though not inclusive of the FIRE economy. Naturally, their real estate values would understate their tax obligations. What’s a government for if it can’t subsidize the wealthiest at the expense of the neediest.

“Had Mitt’s outrageous claim been successful, he would have saved something like $75,000 a year. This amounts to Mitt, buying a pricey home at a time when any half-witted being knew home values were crashing, turning around almost immediately and asking for a discount for buying at a time of falling values. But for a county struggling with the effects of banksters ruining the wealth of its much more average residents, it amounts to a real churlishness about the common good.”

I don’t think this is such a simple issue as this is precisely what Mortgage Resolution Partners is trying to do by saying that there’s been a huge drop in value and it’s pretty universal that a very large number of homes are underwater because they’re worth less than they were a few years ago. Homes with underwater mortgages and homes being worth less than what has been paid for them is a rather pressing national issue and whether someone is rich or poor it doesn’t mean that their home hasn’t gone down in value a significant amount. Aside from impacting the mortgages themselves, this impacts taxes, etc, but I don’t just think you can say because someone has an expensive home their home’s assessed value couldn’t have dropped by a large amount. Lowering the assessed value of homes should happen, but there are going to impacts from that.

@spanishinquisition: Not enough attention is paid to the fact that most existing mortgages were based on valuation during a housing bubble that artificially inflated home values. The deflation that follows was not the fault of the borrower, so why is the borrower the only one saddled with the “moral hazard”? Government policies initiated the inflation of the bubble by easing government policies regulating lending practices, which the Bush Admin took further. Thus, the banks had a hand in this, too. The Real Estate industry had their hands in the trough, too. All parties should share the burden of the moral hazard.

Bob in AZ

I think it’s fair to ask how much Willard Wormtongue and Queen Ann would sell the La Jolla home for if a buyer offered them cash on the spot. I imagine that, despite their machinations to manipulate the assessment to save themselves $29K a year, they would insist the home is valued well north of $12.4 million purchase price in 2008. Would I be wrong in assuming they would ask for something greater than $15 million after they successfully lobbied to reduce the 2012 assessment to “only” $8.4 million?