As Government Releases Evidence of Systemic Mortgage Fraud, FBI Focuses on Distressed Homeowner Fraud

The Administration finally released the HUD Inspector General Reports that consist of the only investigation of foreclosure fraud conducted as part of the foreclosure settlement.

I’ll probably have more to say about the reports tomorrow. But here’s a hint. The Wells Fargo report describes WF management refusing almost all cooperation.

Wells Fargo provided a list of 14 affidavit signers and notaries and then initially restricted our access to interview them. Wells Fargo attorneys interviewed them first and then only allowed us to interview 5 of the 14 affidavit signers. Wells Fargo told us that we could not interview the others because they had reported questionable affidavit signing or notarizing practices when it interviewed them. After discussion with attorneys for Wells Fargo and OIG counsel, terms were agreed to, permitting us to interview these remaining nine persons. The terms that Wells Fargo set required that Wells Fargo management and attorneys attend all of the interviews as facilitators. This condition resulted in delays and may have limited the effectiveness of those interviews. Wells Fargo’s terms also required that persons we interviewed have private counsel present on their behalf. Wells Fargo chose the private counsel and paid the attorney fees of the persons we interviewed. Wells Fargo was not timely in arranging the private attorneys, which further delayed our interviews.

And it concludes that WF may have have violated the False Claims Act.

Based upon the results of our review, Wells Fargo’s practices may have exposed it to liability under the False Claims Act for submitting the claims for insurance benefits to FHA without following HUD requirements. We provided our preliminary findings to DOJ for its assessment and determination on any potential liability issues.

In other words, the government has been sitting on evidence of significant crime for the last 18 months–crime that resulted in people losing their homes and the government being defrauded.

The government just gave the banks a Get Out of Jail Free Card for those crimes.

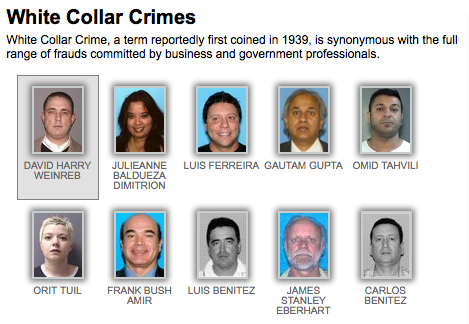

Meanwhile, here’s the financial fraud the FBI says it spent 2011 investigating, while DOJ sat on this evidence and the underlying frauds it clearly would lead to:

Mortgage fraud: During 2011, mortgage origination loans were at their lowest levels since 2001, partially due to tighter underwriting standards, while foreclosures and delinquencies have skyrocketed over the past few years. So, distressed homeowner fraud has replaced loan origination fraud as the number one mortgage fraud threat in many FBI offices. Other schemes include illegal property flipping, equity skimming, loan modification schemes, and builder bailout/condo conversion. During FY 2011, we had 2,691 pending mortgage fraud cases.

Financial institution fraud: Investigations in this area focused on insider fraud (embezzlement and misapplication), check fraud, counterfeit negotiable instruments, check kiting, and fraud contributing to the failure of financial institutions. The FBI has been especially busy with that last one—in FY 2010, 157 banks failed, the highest number since 181 financial institutions closed in 1992 at the height of the savings and loan crisis.

Distressed homeowner fraud, property flipping, and check kiting. That’s what the FBI has been looking at during the entire period when DOJ has just been sitting on this evidence of much greater, more destructive fraud.

Yes the govt. release the results and there will be a lot of talking heads explaining that something really big is coming then ) wins and it all goes dark.

wall street wins again and Main Street better think about joining OWS but then again it’s a crime if to many citizens are thinking evil thoughts about their govt. I’m looking for a fema camp in Long Beach or there abouts;)

Thanks for this report, EW. The perverted sense of justice on display in your report is disgusting.

Bob in AZ

And if I remember correctly EW, we all wondered at the time why the lawsuits by the FHFA didn’t include Wells Fargo.

Can you say the criminal banksters are in bed with the law enforcement authorities? Nothing but blowjobs for all? I thought you could.

Totally OT, but the ACLU has an interesting blog post up today:

Also OT, but interesting – via Josh Rogin over at the Foreign Policy blog:

Some more background:

http://neweconomicperspectives.org/2012/01/holder-obamas-propaganda-is-belied-by.html

My mental facilities must be failing, or I must be confused…but I am sure I did see an interview where President Obama said the reason there had been no prosecutions is bacause no laws were broken…maybe it is that due process thing working out differently for bankers than for medical pot users.

@MadDog: Waterboarding illegal? Who knew?

/s

Bob in AZ

@jerryy:

He gets a lot more in donations from banksters than from medical mj users. Follow the money, as usual.

@jerryy: I think you’re not remembering the nuances in the interview. IIRC, Obama and the DOJ are arguing, in essence,

“Well, golly gee, Fraud is such a difficult thing to prove in court, bc you have to prove *intent*, and gee whiz, how do we know what was going on in their minds? We *think* they probably committed fraud, but we don’t think we can *prove* it in court so, you know, we can’t really indict them.”

Bob in AZ

@Bob Schacht: Shorter CIA: “It’s news to us.”

“The government just gave the banks a Get Out of Jail Free Card for those crimes.”

If we know the DOJ knew about these crimes but got nothing in return for absolving the banks of the crimes (like bigger names to prosecute–more little fish to fry does not count), then it is too bad that we cannot indict them for obstruction of justice.

Close to this topic:

Yves Smith has a post today at nakedcapitalism.com about “JP Morgan Under OCC Investigation for Serious Debt Collection Abuses”

One commenter, Linda Almonte, (the same name as the whistleblower in the JPMorgan investigation and perhaps one and the same) left this comment under Yves’ post:

Well, I certainly hope some or any of these investigations takes hold and breaks apart the bankster icebergs covering and relentlessly destroying the good ‘ole USA (and world).

Ms. Almonte’s request to get our Attorney Generals involved sounds optimistic. I wish she would write more about what we citizens can do right now.

Let there be sunlight and heated investigations.

What this means is that the WH theme of “we didn’t know” is still just so much hogwash. They could claim ignorance by rushing to the agreement before the SF report came out, but not this one.

Coattails trail s__t as well. Kamala’s getting a little note in the morning

You have a headline typo: Morgage

Stop the settlement!

@Jerry: Egads. Thanks.

@MadDog:

Really? The judge allowed this?

am i mistaken, or are most of the names with the photos on the left of your column “foreign”.

were holder’s (and the whitehouse’s you can be sure) attack on homeowner fraud shown to be connected to obama’s re-election campaign and to be an effort to turn attention away from the president cover-up of home mortgage fraud at major american banks, that is,

of white house and doj and sec officials covering-up misconduct that tolerated, encouraged, or authorized various forms of home mortgage servicing fraud and, separately, of home mortgage securitizing fraud,

it would, in my view, add a whole new dimension of amorality to barack obama’s presidential persona.

Matt Taibbi has several new columns out recently on the mortgage crisis, one exposing the crimes of JP Morgan Chase (“J.P. Morgan Chase’s Ugly Family Secrets Revealed,” March 13, 9:18 AM ET), and the other on the Bank of America (“Bank of America: Too Crooked to Fail“, March 14.

“The bank has defrauded everyone from investors and insurers to homeowners and the unemployed. So why does the government keep bailing it out?”

But the most devastating may be Goldman Executive Greg Smith’s Brave Departure (March 14) along with his op-ed piece in the NYT. This is because people invested in GS may just decide to take their money elsewhere, instead of being treated as sheep to be fleeced by Goldman Sachs. Besides the Op-Ed piece by Smith, we have also the report by Carl Levin. So, while GS tries to belittle Smith, there is plenty of evidence from other sources to validate what he is saying.

Bob in AZ